The rhythmic crunch of a potato chip, the familiar snap of a biscuit, the comforting slurp of instant noodles—for decades, these have been the ubiquitous sounds of India’s consumer growth story.

The nation’s voracious appetite for packaged snacks has fueled a multi-billion-dollar industry, making it a beacon for global FMCG players and a cornerstone of the domestic economy.

This seemingly perpetual motion machine, driven by rising incomes, rapid urbanization, and a deep-seated cultural affinity for snacking, has long been a one-way bet on growth.

However, the narrative for 2025 has taken a sharp, unexpected turn. The engine of this munching mania is sputtering.

The market has hit a formidable and revealing “crunch point.” This is not a fleeting downturn but a complex inflection point, signaling a fundamental maturation of the Indian market.

It reflects a new reality shaped by persistent inflationary pressures, a post-pandemic societal recalibration, and, most profoundly, the rise of a newly conscious consumer who wields purchasing power with unprecedented scrutiny.

For brands, investors, and manufacturers, navigating this new landscape is the strategic imperative of our time.

Understanding the intricate dynamics of this slowdown is no longer optional; it is essential for survival and future growth.

This in-depth analysis will dissect the critical data behind the packaged food consumption slowdown, explore the multifaceted drivers of this change, and illuminate the significant strategic opportunities that invariably emerge from such moments of market disruption.

In a market long defined by its dynamism, the latest figures present a stark and sobering picture.

The language of double-digit growth has been replaced by the vocabulary of stagnation.

To understand the depth of this shift, one must look beyond value, which can be inflated by rising prices, and focus on volume—the true measure of consumption.

According to market research from Kantar, a global leader in consumer insights, overall packaged snack consumption per household in India has ceased its upward climb, holding steady at approximately 12.8 kg in FY25.

While this figure demonstrates that snacking remains deeply embedded in the Indian lifestyle, the crucial insight lies in the growth trajectory.

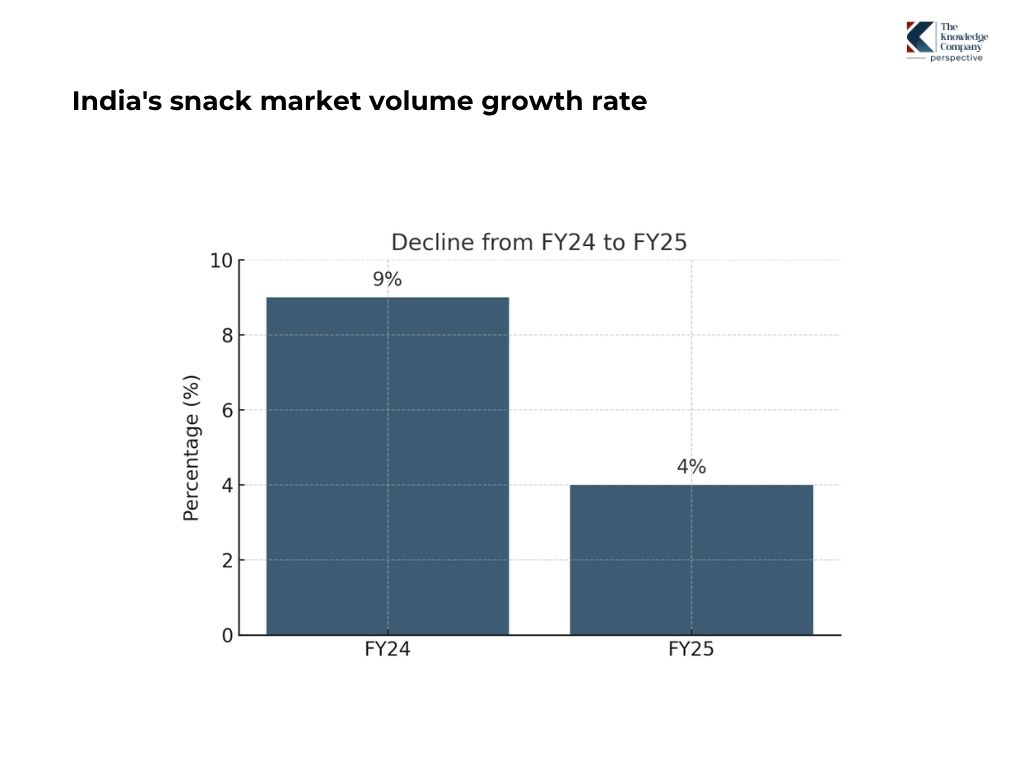

The market’s volume growth rate—the most honest indicator of consumer demand—was more than halved in a single year, plummeting from a robust 9% in FY24 to a mere 4% in FY25.

This sharp deceleration is a clear signal that the era of effortless expansion, driven by simply reaching new consumers, is over.

The battleground has now shifted to winning a larger share of a more constrained and discerning consumer’s wallet.

The impact of this packaged food consumption slowdown reverberates across all major categories, revealing specific vulnerabilities and shifts in consumer priorities:

Its growth has all but evaporated, collapsing from a healthy 10% in FY24 to just 1% in FY25.

For a staple product found in nearly every kiranastore and kitchen cupboard from Kerala to Kashmir, this near-zero growth signifies intense pressure on household budgets, where even small, affordable indulgences are being re-evaluated.

It also points to potential market saturation and an urgent need for innovation beyond standard cream and glucose variants.

The post-pandemic return to offices, schools, and out-of-home dining has naturally reduced the reliance on quick, at-home meals, causing the category’s once-steep growth curve to flatten considerably.

While it remains a relative bright spot, it has not been immune to the slowdown. Its expansion has moderated from a brisk 11% to a more sober 7%, indicating that even this segment is feeling the effects of consumer caution and market fatigue.

These figures, in aggregate, paint the portrait of a market at a crossroads. To navigate forward, it’s essential to understand the powerful undercurrents causing this shift.

The current stagnation is not a random event but the result of a confluence of powerful forces. It’s a perfect storm where economic hardship, societal shifts, and evolving consumer psychology have converged to reshape the snacking landscape.

The most immediate and visceral pressure point for the Indian consumer has been relentless food inflation.

Edible oil, a critical input for a vast majority of fried snacks, has seen its price surge by an alarming 40-45% over the past year.

This, coupled with rising costs for grains, spices, and fuel, has squeezed manufacturer margins to unsustainable levels.

The industry’s primary response has been the widespread adoption of “shrinkflation”—the subtle art of reducing product grammage while maintaining the familiar price point.

The ₹5 or ₹10 packet of chips or biscuits, a cornerstone of the industry’s volume strategy, now contains less product.

The Indian consumer, renowned for their value-consciousness, has noticed. This has triggered a strategic behavioural shift.

A late 2024 survey by Mondelez confirmed that consumers are actively managing their budgets by purchasing smaller quantities and, significantly, demonstrating a greater willingness to switch to more affordable regional or unbranded alternatives.

This is not an abandonment of snacking, but a calculated pivot that erodes brand loyalty and directly impacts the volumes of established national players.

The global pandemic created a unique, contained ecosystem that hyper-accelerated at-home consumption.

With lockdowns confining people to their homes, packaged snacks became a source of comfort, a cure for boredom, and a substitute for out-of-home entertainment. This created an artificial growth bubble.

As leading industry analyst K Ramakrishnan of Kantar has noted, the current slowdown is a logical and “expected correction.”

With the resumption of daily life—commuting to offices, attending schools, and socializing in restaurants and cafes—the patterns of consumption are naturally reverting to pre-pandemic norms.

The constant, all-day grazing has been replaced by more structured meal times and on-the-go options. The market is not in a recession; it is simply normalizing after an unprecedented demand shock.

Beneath the economic and social shifts lies a quieter but equally potent factor: consumer fatigue.

For years, the market has been saturated with “me-too” products and incremental flavour extensions. The paradox of choice has led to a sense of monotony.

This is not merely a failure of marketing creativity but a direct symptom of deeper, systemic challenges in the Indian food processing sector, particularly a chronic underinvestment in genuine Research & Development.

This innovation deficit has left the door wide open for new trends to capture the consumer’s imagination.

As the growth of traditional mass-market snacks stalls, a powerful new movement is gathering force, driven by a consumer who is more informed, more health-conscious, and more demanding than ever before.

This is not a niche trend but a mainstream shift in consciousness.

The “Healthy Snacking Report 2024” by Farmley, a comprehensive study surveying over 6,000 individuals, serves as a definitive guide to this new consumer mindset.

Its findings are revolutionary: 67% of consumers now identify makhanas (fox nuts) and dry fruits as their preferred snack choices. This preference transcends generational divides, with makhanas proving immensely popular among Gen Z (49%), Millennials (59%), and Gen X (47%). Their appeal lies in a perfect trifecta of attributes: they are light, satisfyingly crunchy, and packed with nutrients, offering a “guilt-free indulgence.”

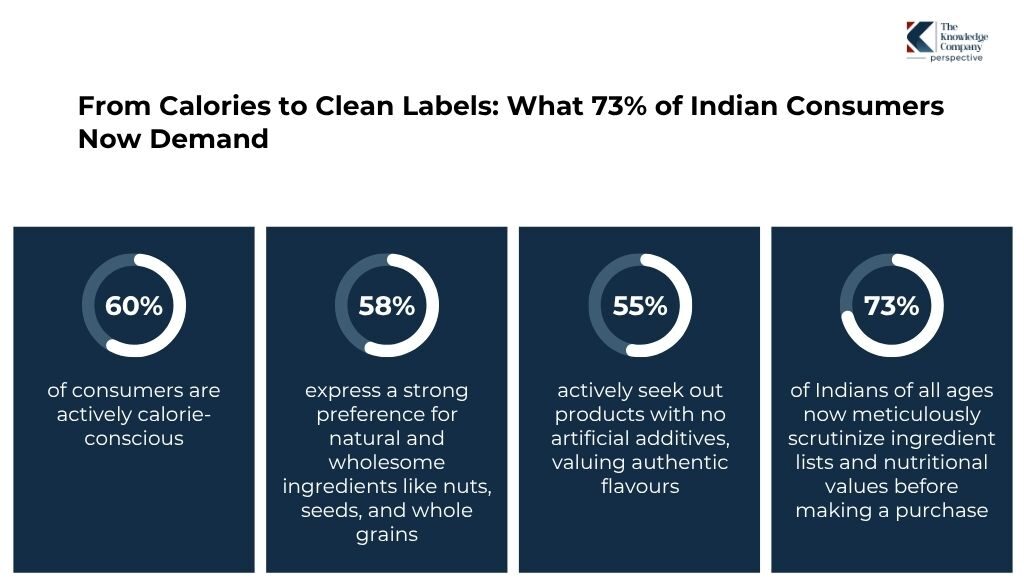

The modern Indian snacker is now a detective. The demand for healthy snacking in India is no longer a vague desire but is defined by a precise set of criteria:

This quest for knowledge culminates in a powerful behavioural statistic: 73% of Indians of all ages now meticulously scrutinize ingredient lists and nutritional values before making a purchase.

This habit is particularly ingrained in the Boomer generation (78%).

This consumer-led demand for transparency means that proposed FSSAI regulations—such as mandatory front-of-pack warnings about high salt, sugar, and fat—are not just a top-down regulatory push but a market imperative that brands ignore at their peril.

Despite an overwhelming desire to eat healthier—with a reported nine in ten consumers wanting to switch—a significant hurdle remains: cost.

For 58% of consumers, the premium price of healthy alternatives is a major barrier. A kilogram of makhanas, for example, can command a price of up to ₹1,500, placing it firmly outside the weekly budget of the average household.

Solving this price-health equation is arguably the single greatest business opportunity in the Indian snack market today.

While one segment of the market pivots to health, another is reaffirming its deep cultural roots.

The traditional Indian snacks market is proving remarkably resilient, a fact quantified by definitive data from market research leader NielsenIQ.

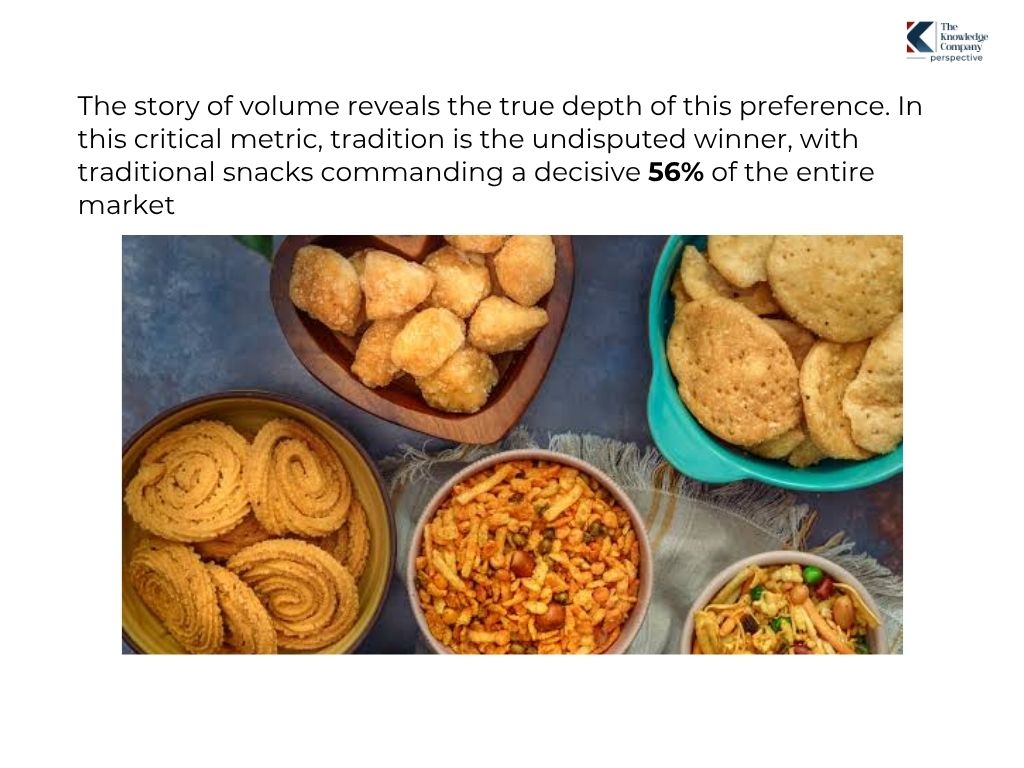

For the fiscal year 2023-24, within a salty snacks market valued at approximately ₹50,800 crore, the value sales of traditional items like bhujia and namkeen remarkably matched the entire portfolio of Western snacks.

However, the story of volume reveals the true depth of this preference. In this critical metric, tradition is the undisputed winner, with traditional snacks commanding a decisive 56% of the entire market.

This enduring dominance is testament to India’s inherent taste profile and a significant post-pandemic trend: a flight to safety and hygiene.

Consumers still crave their beloved traditional snacks, but they now demand the quality assurance that comes with a trusted, sealed packet.

This has created a golden era for organized players like Haldiram’s, whose snack sales reached a colossal Rs 12,161 crore in 2023-24, along with other titans like Balaji Wafers and Parle Products, who have successfully professionalized the ethnic snack category.

The industry’s capacity to innovate and respond to these complex consumer demands is fundamentally linked to the health of the underlying food processing industry in India.

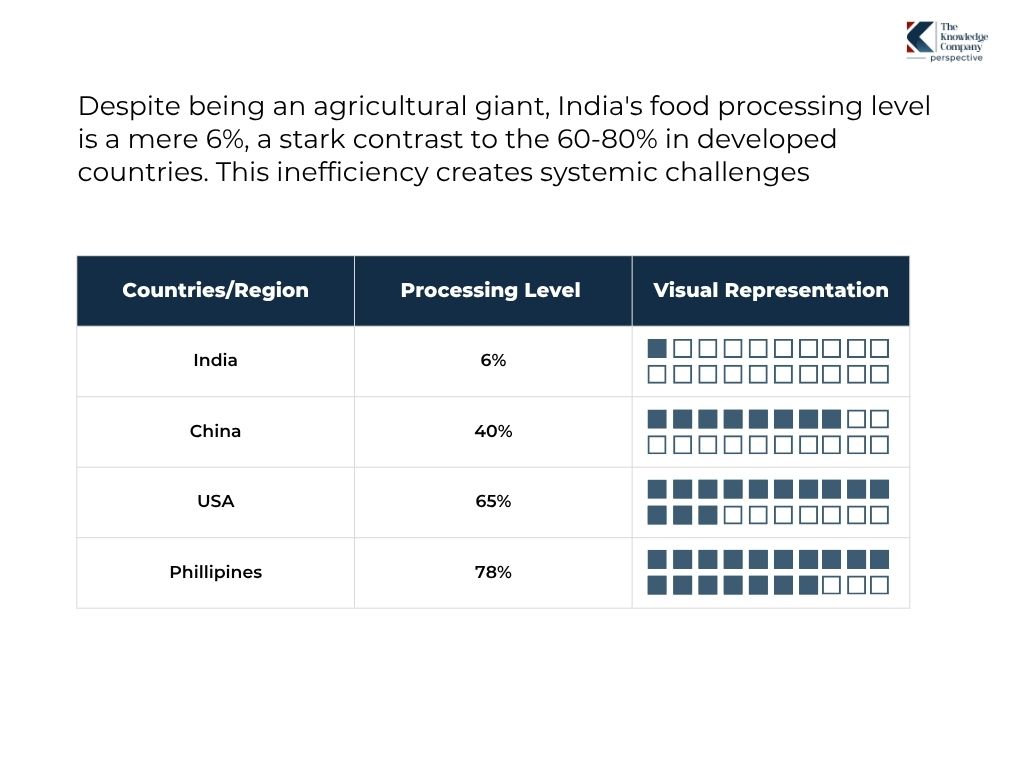

Despite being an agricultural giant, India’s processing level is a mere 6%, a stark contrast to the 60-80% in developed countries. This inefficiency creates systemic challenges.

The absence of a robust, end-to-end cold chain and efficient logistics leads to massive post-harvest wastage of perishable goods like fruits, vegetables, and dairy.

This not only represents a tragic loss of resources but also severely restricts the palette of fresh, natural ingredients that manufacturers can use to create innovative, value-added products.

The fact that 80% of the packaged foods market remains in the unorganised sector poses a dual challenge. It creates an uneven playing field for compliant, tax-paying organized players and presents a monumental task for the FSSAI in enforcing uniform standards of quality, safety, and labelling across millions of small producers.

This “crunch point” should not be viewed as a crisis but as a clarifying moment that reveals the strategic path forward. For agile and perceptive businesses, the opportunities are immense.

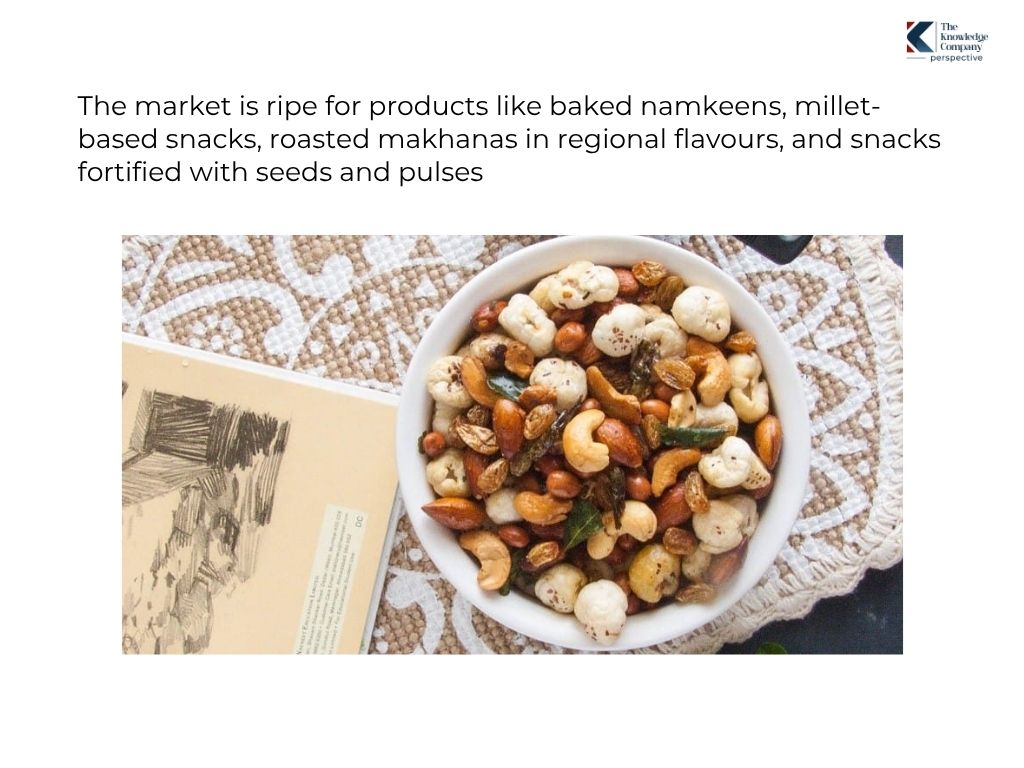

The most significant opportunity lies at the intersection of India’s two strongest trends: health and tradition.

The market is ripe for products like baked namkeens, millet-based snacks, roasted makhanas in regional flavours, and snacks fortified with seeds and pulses.

This requires a shift from commodity-driven products to science-led, consumer-centric formulations.

Addressing the affordability of healthy snacks is key to unlocking the mass market.

This involves value engineering, creating efficient supply chains for natural ingredients, and employing strategic SKU sizing to offer accessible, low-unit-price packs that encourage trial and adoption.

True market leadership will require a long-term vision. Investing in R&D is the only way to break the cycle of product monotony and create genuinely novel offerings.

Similarly, investing in supply chain infrastructure is not merely a cost but a strategic imperative to reduce wastage, ensure quality, and build a competitive moat.

India’s snack market has not lost its appetite; it has developed a more discerning palate. The current slowdown is a healthy and essential market correction, pruning the excesses of the past and paving the way for a more sustainable future.

The consumer is sending clear signals: they want healthier options, they cherish their traditional tastes, they demand transparency, and they are acutely aware of value.

The government’s ambitious goals—to elevate the food processing level to 20% and grow India’s share in global food trade to 3%—provide a powerful framework for growth.

The brands that heed the complex signals of this crunch point, that invest in genuine innovation, and that build a foundation of trust with the new Indian consumer will not only navigate this challenging period but will define the next, more prosperous chapter in the nation’s snacking story.

At The Knowledge Company (TKC), we provide a clear roadmap for navigating India’s complex snack market transformation. Our deep expertise in the consumer goods and food processing sectors allows us to translate data-driven insights on consumer behaviour, supply chain dynamics, and regulatory shifts into actionable growth strategies for your business.

We help our clients adapt and win by focusing on:

Need help evaluating the shift to healthy snacking or optimizing your brand for the new consumer landscape?

Reach out to TKC for tailored, forward-looking consulting across the FMCG, food processing, and consumer retail sectors.

The slowdown is not due to a single cause but a combination of factors. The most significant are high commodity inflation (especially in edible oils), which has led to “shrinkflation” and reduced consumer purchasing power, and a post-pandemic market correction as out-of-home consumption returns to normal.

Yes, all data indicates it is a significant and sustainable trend. A majority of consumers (67%) now prefer healthier options like makhanas and dry fruits, and 73% actively read nutrition labels. While cost is a barrier, the underlying demand for natural, low-calorie, and clean-label products is a long-term shift that brands must address.

The FSSAI is playing a more active role in promoting consumer transparency. Their proposed regulations for mandatory Front-of-Pack Labelling (FoPL) to warn about high salt, sugar, and fat, along with crackdowns on misleading terms like “natural,” are pushing brands towards cleaner labels and more honest marketing, aligning with growing consumer demand.