India’s footwear and accessories market navigates 2025 pockmarked by key developments marking a seismic.

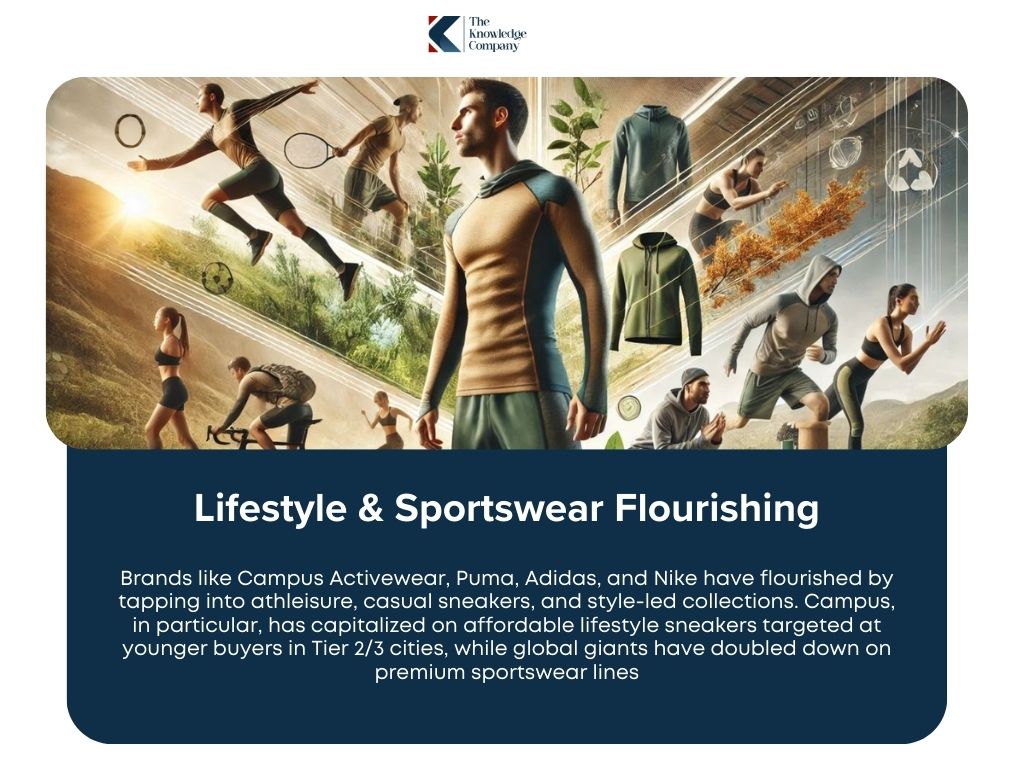

The past few years have revealed shifting consumer preferences, with Gen Z steering demand toward athleisure, lifestyle-driven designs, and sustainable products, leaving traditional mass-market leaders scrambling to stay relevant.

At the same time, bold policy reforms, from GST simplification and sweeping income tax relief to tariff maneuvering in response to global trade frictions are reshaping affordability, pricing, and demand dynamics.

This convergence of youth-driven fashion trends and state-driven fiscal stimulus is setting the stage for one of the most transformative decades in Indian retail.

India’s consumer market in general is undergoing a dual transformation – on the one hand powered by demographics, incomes, digital adoption, and aspirational lifestyles, and on the other shaped by recent sweeping fiscal and trade reforms.

With private consumption accounting for nearly two-thirds of GDP in late 2024, policymakers have placed consumer demand at the center of their economic playbook.

The simplification of GST, rollout of the new Income Tax Act, 2025, and responses to global tariff shocks are not only shaping the broader retail market but directly influencing how Indians buy, spend, and consume fashion, footwear, and accessories.

The footwear and accessories sector, already a high-potential growth engine, now finds itself at the crossroads of structural demand drivers and policy-led consumption stimulus. This alignment makes 2025 a watershed year for the industry.

The latest wave of reforms and global shifts has profound implications for India’s footwear and accessories sector. Rather than abstract policy moves, these changes are directly reshaping how shoes, sneakers, and fashion accessories are made, priced, and consumed.

The simplification of GST into two primary slabs (5% and 18%) reduces complexity and compliance costs across the footwear value chain.

Earlier, footwear was taxed differently depending on price points; now, clearer and often lower rates apply to both finished goods and inputs like rubber, synthetics, and adhesives.

This eases margins for manufacturers and makes mid-range branded footwear cheaper for consumers. Accessories such as belts, wallets, and handbags, previously taxed at higher rates, are now more affordable, spurring demand.

Coming just before Navratri and Diwali, these changes are expected to lift festive sales across both urban malls and Tier 2/3 e-commerce platforms.

The new Income Tax Act, 2025, and the raised exemption threshold (~₹12 lakh effectively tax-free) have expanded middle-class disposable income.

Footwear and accessories, often treated as lifestyle or fashion purchases by Gen Z and millennials, are among the first discretionary items to benefit.

Sneakers, athleisure shoes, and premium accessories are now within easier reach for middle-income households.

Campus Activewear and Puma are seeing a surge in entry-level lifestyle footwear sales, while luxury players like Adidas Originals and Nike Air Jordan tap into the aspirational segment.

Traditional brands such as Bata and Relaxo face pressure to innovate as consumers migrate toward more stylish alternatives.

The imposition of U.S. tariffs (up to 50%) on Indian goods has hit leather footwear exports hard, especially in Tamil Nadu and Agra clusters.

Exporters face tighter margins and shrinking orders, with revenue declines projected at 5–10%. However, government reforms, especially GST cuts and income tax relief, are designed to shift the industry’s focus inward.

By strengthening domestic consumption, policymakers are helping footwear brands redirect capacity from export markets to India’s own fast-growing consumer base.

This domestic cushion ensures that even if exports stall, demand at home continues to rise.

Together, these developments mark a turning point. Input costs are easing, household wallets are fatter, and domestic demand is accelerating just as exports face headwinds.

For footwear and accessories players, the opportunity lies in doubling down on design-led innovation, pricing transparency, and omni-channel retail to capture this policy-driven consumption wave.

In essence, reforms and trade shocks are pushing the sector away from dependency on exports and toward a robust, internally powered growth model.

The footwear and accessories segment remains a cornerstone of India’s retail mix, but the dynamics powering this growth have shifted in recent years.

India stands as the world’s second-largest producer and consumer of footwear, backed by a vast domestic market and deep manufacturing capabilities.

Nearly 90–95% of production is absorbed locally, highlighting the strength of homegrown demand.

The sector’s trajectory is fueled by favorable demographics – a young population with a median age under 30, rapid urbanization, and a rising middle class.

Crucially, recent policy interventions such as GST simplification and the new Income Tax Act have further expanded consumer spending power, enabling households to allocate more toward lifestyle-driven categories.

Consumers are no longer buying footwear and accessories purely for functionality; they are seen as lifestyle statements and symbols of status.

This trend is clearest among Gen Z and millennials, who are gravitating toward athleisure, design-led sneakers, and sustainable products.

While legacy brands like Bata and Relaxo face challenges adapting to these shifts, players like Campus Activewear, Puma, and D2C startups are flourishing by aligning with style-first, youth-driven preferences.

On the supply side, initiatives such as Make in India and the Indian Footwear and Leather Development Programme (IFLDP) aim to boost domestic manufacturing, improve infrastructure, and enhance global competitiveness.

Meanwhile, the rapid growth of e-commerce has democratized access, making a wider variety of products available across Tier 2 and Tier 3 cities, which now account for a majority of online demand.

Together, these forces position footwear and accessories as one of the key engines of India’s retail growth story.

The Indian footwear and accessories market presents a compelling growth narrative, underpinned by favorable demographics, rising incomes, and evolving consumer aspirations.

Understanding the market’s current scale, projected trajectory, key segments, and regional dynamics is crucial for stakeholders navigating this vibrant sector.

The Indian footwear and accessories market, along with the broader fashion retail sector, demonstrates significant scale and robust growth potential. Synthesizing data from various sources provides a comprehensive view:

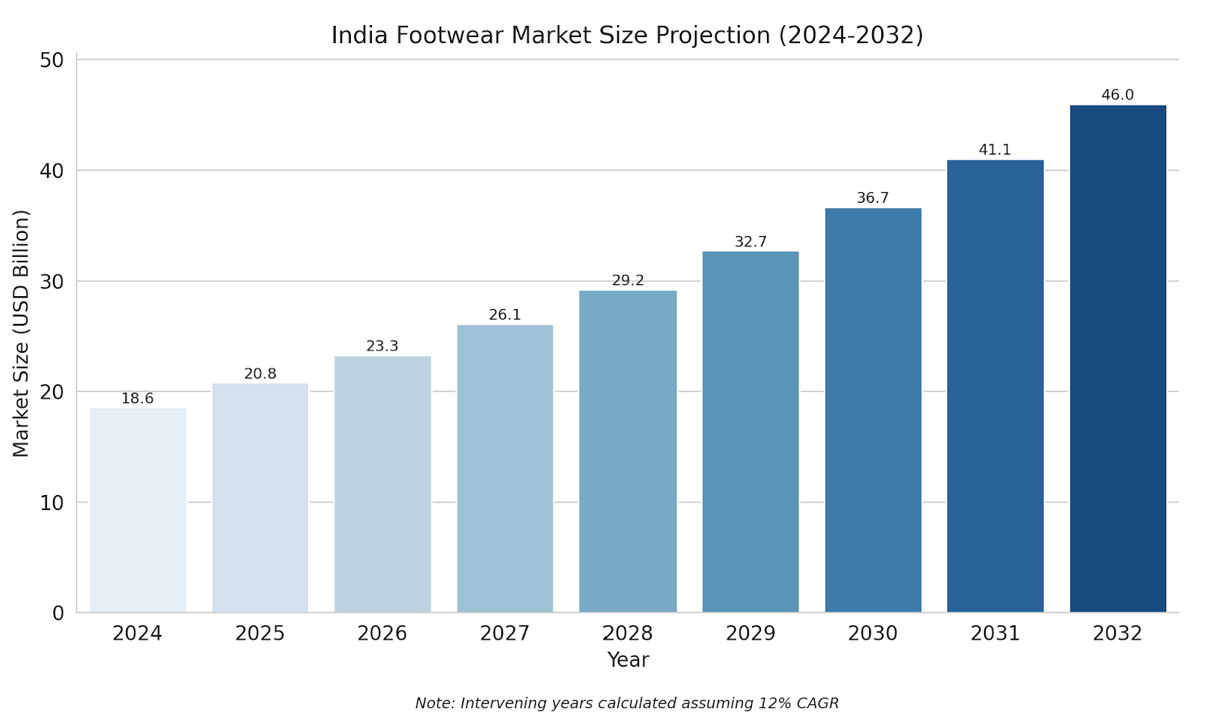

Table 1: India Footwear Market Size Projection (USD Billion) (Estimate based on ~12% CAGR)

Year | Market Size (USD Billion) |

2024 | 18.57 |

2025 | 20.80 |

2026 | 23.29 |

2027 | 26.09 |

2028 | 29.22 |

2029 | 32.73 |

2030 | 36.65 |

2031 | 41.05 |

2032 | 45.98 |

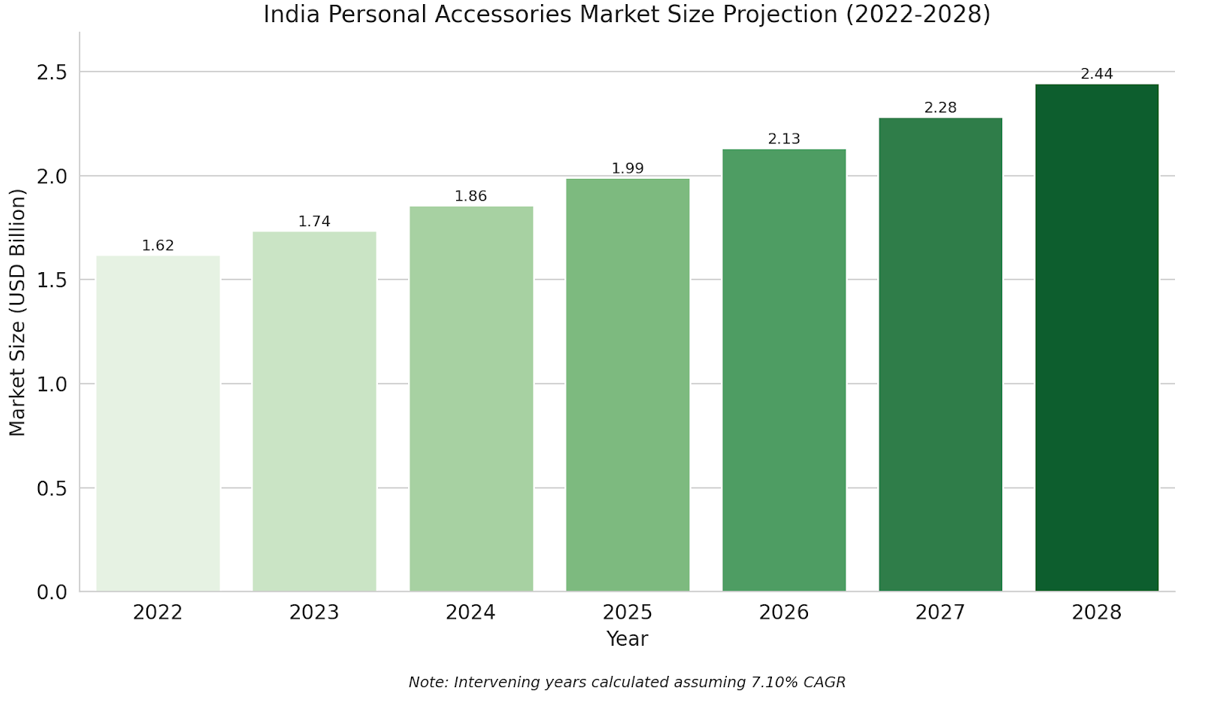

Table 2: India Personal Accessories Market Size Projection (USD Billion) (Estimate based on 7.10% CAGR)

Year | Market Size (USD Billion) |

2022 | 1.62 |

2023 | 1.74 |

2024 | 1.86 |

2025 | 1.99 |

2026 | 2.13 |

2027 | 2.28 |

2028 | 2.44 |

Table 3: India Overall Fashion Retail Market Size Projection (USD Billion) (Estimate based on ~12.5% CAGR)

Year | Market Size (USD Billion) |

2024 | 59.00 |

2025 | 66.38 |

2026 | 74.67 |

2027 | 84.01 |

2028 | 94.51 |

2029 | 106.32 |

2030 | 119.61 |

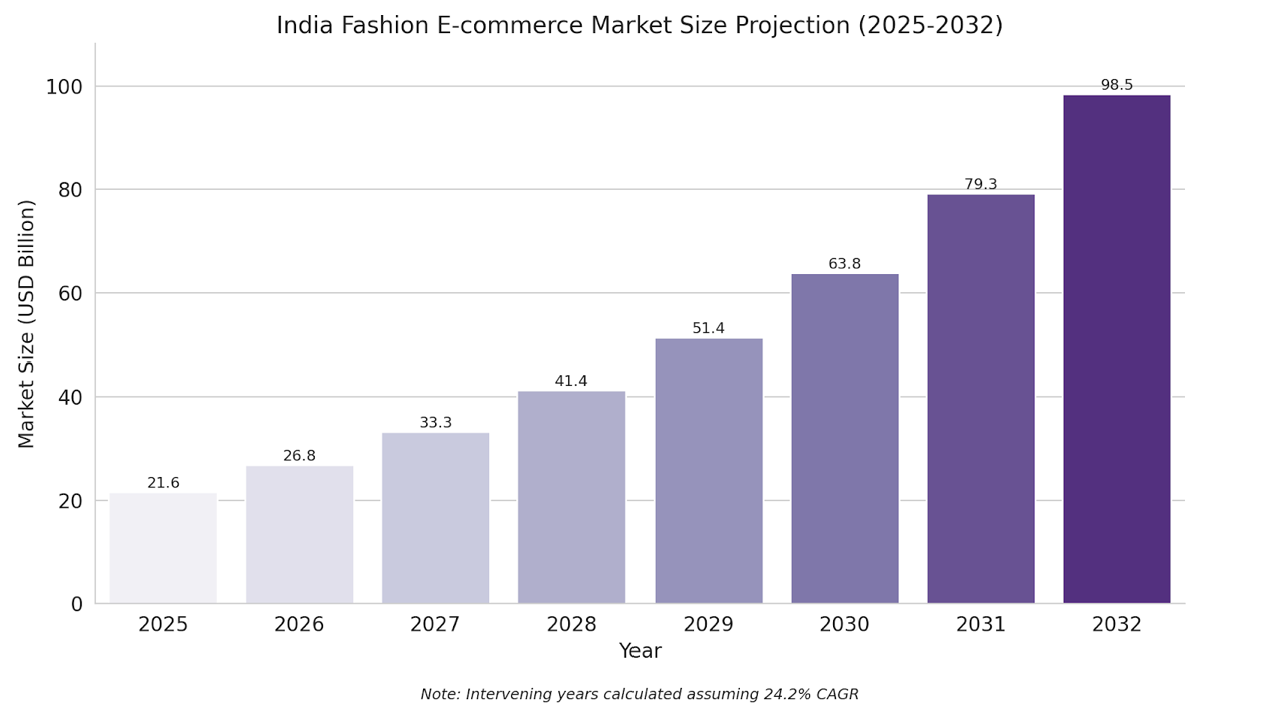

Table 4: India Fashion E-commerce Market Size Projection (USD Billion) (Estimate based on 24.2% CAGR)

Year | Market Size (USD Billion) |

2025 | 21.60 |

2026 | 26.83 |

2027 | 33.32 |

2028 | 41.38 |

2029 | 51.40 |

2030 | 63.84 |

2031 | 79.28 |

2032 | 98.47 |

This data clearly indicates a steady market with strong fundamentals. The footwear sector is a major component in Indian fashion, poised for consistent double-digit growth.

While accessories data is less consolidated, it points towards similar, if not faster, expansion, driven by fashion cycles and personalization trends.

Perhaps most strikingly, the significantly higher CAGR for fashion e-commerce compared to overall fashion retail underscores a fundamental shift in consumer purchasing behavior and channel preference, driven by digital adoption and convenience.

Category | Base Year & Value (USD Bn / INR Cr) | Projected 2030 Value (USD Bn / INR Cr) | CAGR (%) | |

Overall Footwear | 2024: ~$18-19 Bn / ~1.5-1.6 Lakh Cr | ~$25 Bn (by 2028) / ~$45-50 Bn (by 2032) | ~11-13% | |

Fashion Accessories | 2020: ~$3.8 Bn / ~285.6 Bn INR | Significant Growth Expected | >12-15% | |

Personal Accessories | 2022: $1.62 Bn / ~13.5K Cr | $2.41 Bn (by 2028) | ~7.1% | |

Sustainable Footwear | 2022: $0.34 Bn / ~2.8K Cr | $0.58 Bn (by 2030) | ~7% (2023-30) | |

Fashion Retail (Total) | 2024: ~$60 Bn / ~5 Lakh Cr | ~$125 Bn (by 2030) | ~12-13% | |

Fashion E-commerce | 2025: $21.6 Bn / ~1.8 Lakh Cr | ~$98 Bn (by 2032) | ~20-24%+ |

While the long-term outlook is promising, the past two to three years have seen footwear consumption struggle.

Demand has softened in traditional categories as Gen Z, now a powerful consumer cohort, increasingly rejects generic and functional footwear in favor of stylish, lifestyle-driven, and athleisure designs.

This shift has created winners and losers:

The contrast underscores a structural consumption shift: footwear is no longer just a necessity but a lifestyle statement, and brands that fail to innovate around design, digital-first marketing, and sustainability risk losing relevance.

The Indian footwear market is diverse, with several key segments driving growth:

Non-athletic footwear dominates market share. Casual and formal styles lead traditionally. Athletic footwear grows rapidly. Athleisure fuels this trend. Health consciousness drives demand. Sports leagues boost popularity. Lifestyle shifts favor casualization. Global brands like Nike and Adidas lead premium sportswear. Local players like Campus Activewear compete strongly.

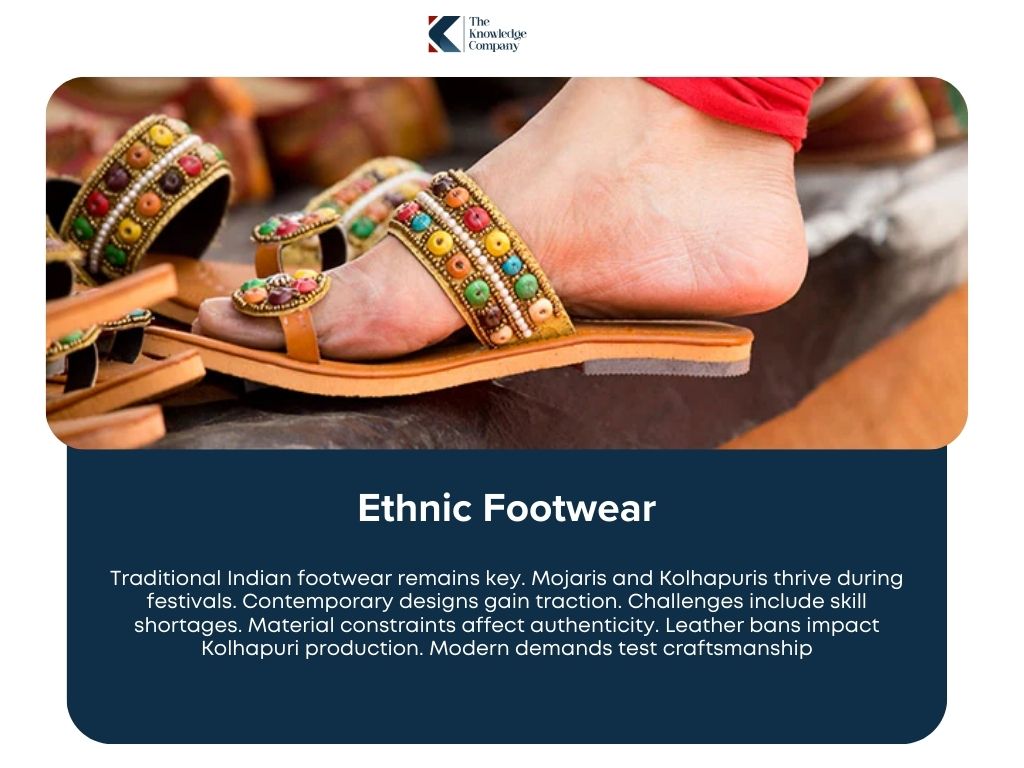

Traditional Indian footwear remains key. Mojaris and Kolhapuris thrive during festivals. Contemporary designs gain traction. Challenges include skill shortages. Material constraints affect authenticity. Leather bans impact Kolhapuri production. Modern demands test craftsmanship.

The luxury segment expands. Rising incomes fuel growth. Brand awareness drives demand. Urban consumers seek exclusivity. Quality craftsmanship attracts buyers. Status motivates purchases. This trend offers positioning opportunities.

Sustainability shapes the market. Eco-friendly materials gain favor. Recycled plastics and plant-based leathers lead. The market was USD 337.6 million in 2022. It may reach USD 578.4 million by 2030. Non-athletic holds 59.95% share. Athletic growth is fastest. Startups innovate with circular models. Non-leather options expand significantly.

Table 2.2: Key Footwear Segments & Trends

Demand patterns exhibit significant regional variations:

Tier 2 and Tier 3 cities drive rapid growth. Demand patterns evolve significantly. These areas are central to brand strategies. They transcend emerging market status. Brands must understand diverse consumer behavior. A metro-centric view is outdated. Tailored approaches are essential. This includes product assortment and pricing. Marketing needs vernacular content. Distribution blends D2C and marketplaces. Engagement with this base is key.

The Indian consumer, particularly concerning footwear and accessories, is undergoing significant behavioral shifts, driven by economic changes, increased awareness, and evolving social norms.

A key trend reshapes the market. Aspirational consumption and premiumization grow beyond metros. Tier 2 and Tier 3 cities lead the shift. Affordability still matters for the mass market. Consumers seek branded, quality, and fashionable products.

Several factors drive this trend:

Rising incomes boost purchasing power. Education levels increase, especially among youth. Digital exposure transforms preferences. Internet and smartphone use are widespread. Social media shapes global trends. YouTube and Meta platforms influence fashion. Vernacular content targets these shoppers. E-commerce bridges metro-non-metro gaps. Tier 2/3 cities dominate online orders.

Consumer mindset evolves. Aspirational buyers seek better experiences. Quality products reflect status and lifestyle. Demand grows for branded durables and fashion. Cafes and accessories gain traction. Premiumization upgrades quality, not luxury. Accessible price points attract buyers. Consumers value style, status, and better offerings.

Brands recognize this potential. Retail expands online and offline. Strategies target ‘Bharat’ aspirations. Flipkart and Meesho succeed in these regions. They cater to diverse needs, from fashion to essentials.

Sustainability is now a core driver of consumer decisions in India’s footwear and accessories market, especially among younger buyers.

Despite higher prices, long-term value and ethical alignment are swaying buying decisions, making sustainability a must-have, not a nice-to-have.

The lines between men’s and women’s fashion are fading, fuelling the rise of unisex accessories in India.

For brands, this means designing with versatility in mind and marketing with inclusivity at the forefront.

Tech and material innovations are reshaping India’s footwear and accessories scene, blending sustainability with next-gen features.

Brands are tapping into locally available resources like cork, banana fibre, and jute to create sustainable, climate-suited products. Startups like Flatheads and Banofi are pioneering shoes and bags using banana stems, while Malai Eco and Thaely upcycle waste materials like coconut water and plastic bags. These innovations reduce carbon footprint and support local artisans.

From GPS-enabled school shoes and fall-detection footwear for the elderly to self-lacing sneakers and health-tracking soles, footwear is going high-tech. Startups like Ducere (Lechal) and IIT Indore are leading with innovations in fitness, safety, and navigation.

AR is enhancing online retail—apps let users virtually try on shoes and accessories, boosting confidence, reducing returns, and increasing sales. While Nykaa Fashion and Reliance are reportedly exploring this, broader adoption by Indian e-tailers like Myntra and Flipkart points to AR as the future of immersive shopping.

Bottom Line: Whether it’s locally sourced materials or high-tech features, innovation is becoming the differentiator for brands targeting today’s eco-conscious, tech-savvy Indian consumer.

India’s footwear and accessories sector is shaped by a blend of policy support, technology adoption, and structural challenges.

Policy Push & Self-Reliance: Government schemes like Atmanirbhar Bharat, PLI, IFLDP, and QCOs aim to boost domestic manufacturing, reduce imports, and enhance exports. These policies target scaling up production, improving quality, and integrating technology. While the leather and footwear sector eyes a USD 13.7 Bn export target by 2030, achieving this demands major improvements in infrastructure, skills, and branding.

Trade Dynamics:

India recorded USD 4.68 Bn in leather and footwear exports in 2023–24, with modest growth projected. However, competition from imports (notably from China) and global tariff shifts add pressure. QCOs are expected to filter substandard imports and push local quality.

Automation vs. Tradition:

AI and automation offer efficiency gains—especially in areas like quality checks and supply chain optimisation—but raise concerns when applied to traditional crafts like Kolhapuri chappals. A balanced approach can relieve physical strain on artisans while preserving handcrafted authenticity.

Key Challenges:

Outlook:

To truly scale and compete globally, India must strengthen policy execution, invest in training, modernise traditional clusters, and enable tech-driven yet craft-sensitive manufacturing ecosystems.

Sustainability and ethics are gaining traction in India’s footwear and accessories sector, shaped by growing consumer awareness, startup innovation, and evolving regulations.

The demand for animal-free leather alternatives is accelerating, driven by environmental and ethical concerns. A wide range of materials is being explored:

Young D2C brands are leading the charge in sustainable product design:

These brands prioritise transparency, cruelty-free credentials (e.g., PETA-approved), and unique material narratives to appeal to conscious consumers.

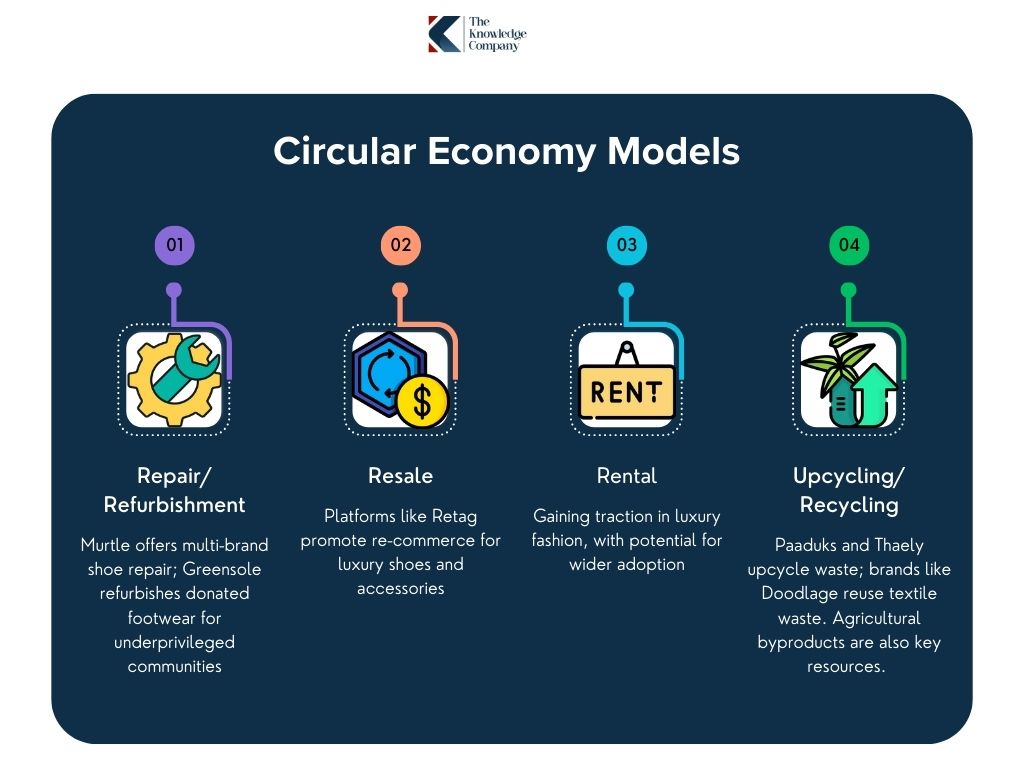

Beyond materials, circularity-focused models are emerging:

Startups are leveraging these models to meet demand for waste reduction and product longevity, aligning economic viability with sustainability.

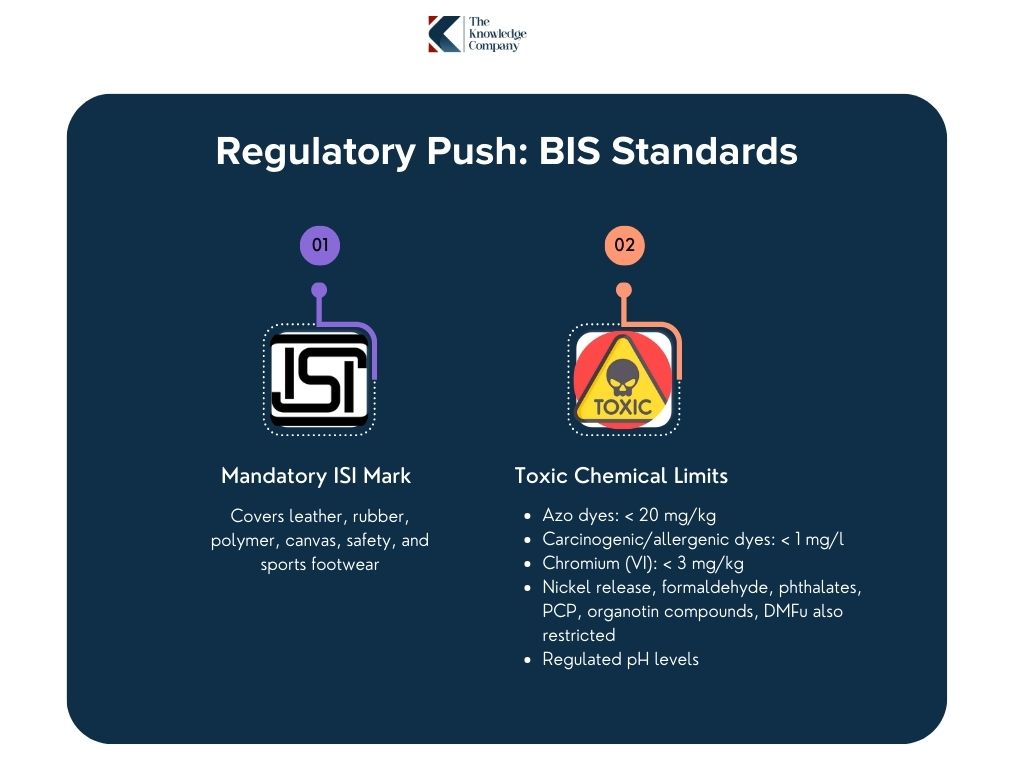

The Bureau of Indian Standards (BIS) is enforcing stricter norms for chemical safety in footwear, effective August 2024 (grace period till July 2026):

These norms aim to standardise safety in an industry still dominated by unorganised players.

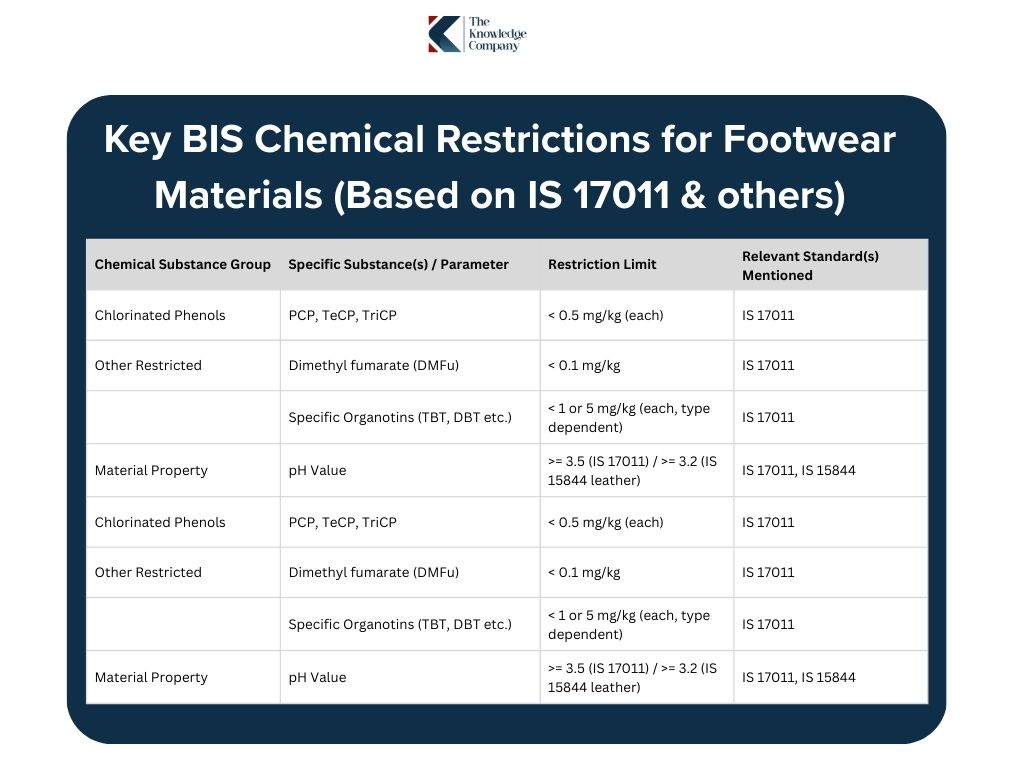

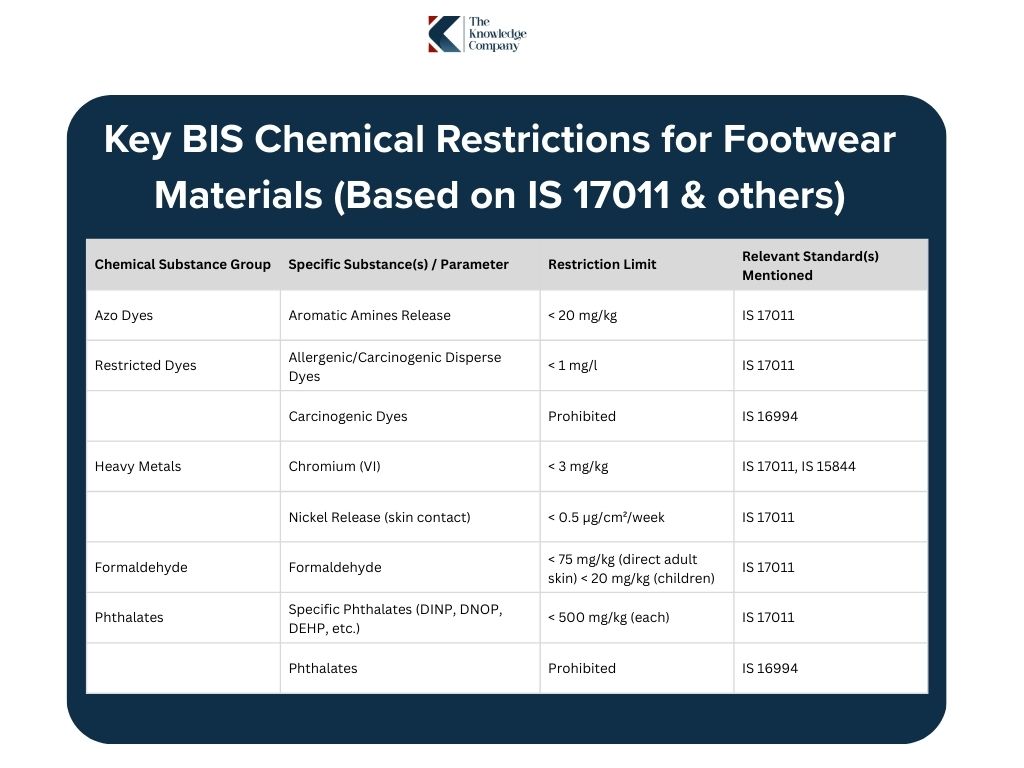

Key BIS Chemical Restrictions for Footwear Materials (Based on IS 17011 & others)

Note: This table summarizes key restrictions based on provided snippets referencing IS 17011 and other standards. Specific applicability may depend on the final product standard.

Note: This table summarizes key restrictions based on provided snippets referencing IS 17011 and other standards. Specific applicability may depend on the final product standard.

The implementation of these mandatory BIS standards represents a significant regulatory shift, pushing the industry towards higher quality and safety benchmarks, particularly concerning harmful chemicals often found in dyes and processing agents.

This aligns with global trends and addresses consumer health concerns. While posing a compliance challenge, especially for the numerous SMEs, adherence to these standards and the use of the BIS mark can become a crucial differentiator, signaling safety and quality to consumers in a competitive market.

India’s footwear and accessories market is being significantly shaped by government policy and the country’s rapidly advancing digital infrastructure.

A key initiative is the Production Linked Incentive (PLI) scheme, designed to boost domestic manufacturing and reduce import reliance under the ‘Atmanirbhar Bharat’ vision.

Nationwide, the Indian Footwear and Leather Development Programme (IFLDP) continues to support MSME integration and sustainable practices, while new BIS-mandated Quality Control Orders (QCOs), effective since 2024 with compliance due by July 2026, are reshaping quality benchmarks and export readiness.

This could generate millions of jobs and substantially increase exports and turnover in the sector. Complemented by the ongoing Indian Footwear and Leather Development Programme, this policy push aims to enhance scale, competitiveness, and global visibility.

The Uttar Pradesh has launched its Footwear, Leather & Non-Leather Area Development Policy 2025 offering capital subsidies, industrial parks, and Centres of Excellence to attract global investors and generate up to 22 lakh jobs.

Though some sectors have seen slower disbursement of funds, the intent remains strong. For footwear and leather, the success of these schemes will hinge on streamlined execution and clear alignment with job creation, quality standards, and global market potential.

On infrastructure, Kanpur’s upcoming 83-acre footwear park and national initiatives like PM Gati Shakti and the National Logistics Policy are accelerating supply chain efficiency, warehousing, and Tier-2/3 city access. Collectively, these measures aim to expand India’s footwear industry to a projected USD 26 billion by 2030, though MSMEs still face compliance costs, infrastructure gaps, and the challenge of adopting sustainable materials at scale.

The e-commerce revolution in India is being decisively shaped by the rise of Tier 2 and 3 cities, where digitally savvy, aspirational consumers are driving a surge in Direct-to-Consumer (D2C) sales.

With India’s e-commerce market projected to reach up to USD 325 billion by 2030, the D2C segment alone could touch USD 300 billion, fashion contributing significantly with an estimated USD 43.2 billion by 2025.

Tier 3 cities, in particular, have seen remarkable growth, with their share of online order volumes rising from 34.2% in 2021 to 41.5% in 2022, now accounting for over half of online shoppers. Cities like Jaipur, Lucknow, Coimbatore, and Patna are fast becoming digital retail powerhouses.

This shift is democratising access to fashion and lifestyle products across India, blurring urban-rural divides and fuelling the demand for trend-led yet value-driven offerings.

For brands, this calls for a robust D2C strategy backed by personalised digital engagement, efficient fulfilment networks, and strong marketplace presence, enabling them to cater to a more distributed yet connected consumer base.

Based on the new developments, here is the updated text accounting for the fiscal catalysts for the footwear sector.

India’s footwear and accessories market stands at an exciting juncture, poised for significant expansion and transformation towards 2030.

Driven by favorable demographics, rising incomes, rapid digitalization, and evolving consumer aspirations, the sector presents immense opportunities alongside notable challenges. The recent pro-consumer fiscal policies, including GST rationalization and income tax reforms, are expected to act as powerful new catalysts, fueling demand and reinforcing the industry’s growth trajectory.

Navigating this dynamic landscape requires strategic agility and focus on key themes:

Looking ahead to 2030, India’s footwear and accessories market is poised to scale impressive heights, with footwear potentially surpassing USD 45–50 billion. The new fiscal catalysts are expected to accelerate this growth. As sustainability becomes the industry norm, circular models are expected to go mainstream. Technology will embed itself more deeply—from hyper-personalization and AI-led supply chains to smart wearables and immersive AR/VR retail.

Growth from Tier 2 and 3 cities will drive cultural and commercial influence, demanding sharper localization strategies. On the supply side, policy-led initiatives like PLI and QCOs, coupled with automation, will elevate manufacturing efficiency and export potential.

The brands that align with these shifts, balancing innovation with local relevance and capitalizing on the renewed spending power of Indian households, will be best positioned to lead in one of the world’s fastest-evolving consumer landscapes.