Authors: Madhulika Tiwari, Partner, Retail & Consumer Goods, The Knowledge Company & Parmesh Chopra, Head Content, The knowledge Company

In 2025, the Indian denim market is experiencing a pivotal transformation, with rapid growth fueled by younger, aspirational, and digitally connected consumers.

Now valued at USD 5.4 billion (The Knowledge Company estimates), India’s denim apparel sector is expected to expand at approximately 16% CAGR through 2030, signaling tremendous opportunity for both new and established brands in the industry.

Despite strong consumer demand, the supply base for denim in India remains fragmented and traditional.

Bridging this gap through investment in modern manufacturing technology, efficient supply chains, and sustainable practices is increasingly vital for market leaders and challengers alike.

Unlike mature global markets, the Indian denim industry in 2025 offers substantial room for expansion in volume and value, as evidenced by emerging trends.

Women’s denim wear, once a small segment, is now gaining prominence and driving growth.

Meanwhile, Tier-2 and Tier-3 cities are fueling rising demand, benefiting from higher disposable incomes, greater digital access, and evolving lifestyle aspirations.

Modernization and sustainability are no longer optional. The adoption of AI-based forecasting, automated finishing, sustainable materials, and water-efficient processes has become essential to maintaining competitiveness.

Larger, well-capitalized firms are able to adapt, whereas smaller players continue to face the pressure of meeting new industry standards.

Recent policy initiatives such as the Production Linked Incentive (PLI) scheme and new trade agreements are reshaping India’s competitive position, unlocking fresh opportunities for export and sectoral investment.

As a result, the Indian denim market in 2025 is not only expanding in size, it is evolving.

Driven by shifts in consumer demand, technology, sustainability, and supportive government policies, India’s denim industry is steadily becoming more organized, modern, and globally competitive.

The Indian denim market in 2025 is defined by a uniformly positive and compelling growth narrative. Denim has successfully woven itself into the fabric of Indian life, becoming a staple in households far beyond just traditional jeans.

The Indian denim market in 2025 is defined by a uniformly positive and compelling growth narrative. Denim has successfully woven itself into the fabric of Indian life, becoming a staple in households far beyond just traditional jeans.

To understand the market’s full potential, it’s essential to analyze its current size, product mix, global standing, and the core forces shaping its future.

The market’s financial outlook is exceptionally strong. Driven by a surge in disposable incomes, the adoption of western-style trends, and expanding retail penetration, the market is on a rapid upward trajectory.

While “denim” is a broad category, its value is concentrated in a few key areas.

The market’s high growth rate is supported by a simple fact: India’s per capita consumption of denim is still incredibly low.

Closing this gap offers substantial upside.

To reach a modest benchmark of just one pair per person annually, India would need to sell an additional ~700 million pairs of jeans every year.

This scenario points not just to incremental growth but to potential market multiplication, positioning Indian denim as one of the most attractive opportunities in the global apparel sector for the next decade.

On the global stage, India plays a dual role: it is solidifying its position as both a key manufacturing hub and a critical growth market.

The next phase of India’s growth will depend on its ability to move up the value chain, evolving beyond production strength to build brand-led, innovation-driven leadership.

The market’s future is shaped by a central tension: powerful demand-side drivers are being met with significant supply-side challenges.

The Indian denim market in 2025 is defined by this duality: robust, modernizing consumer demand on one side, and an uneven, traditional supply environment on the other. The companies most likely to succeed will be those that can build modern, agile, and technology-enabled supply chains capable of meeting this rising demand efficiently and profitably

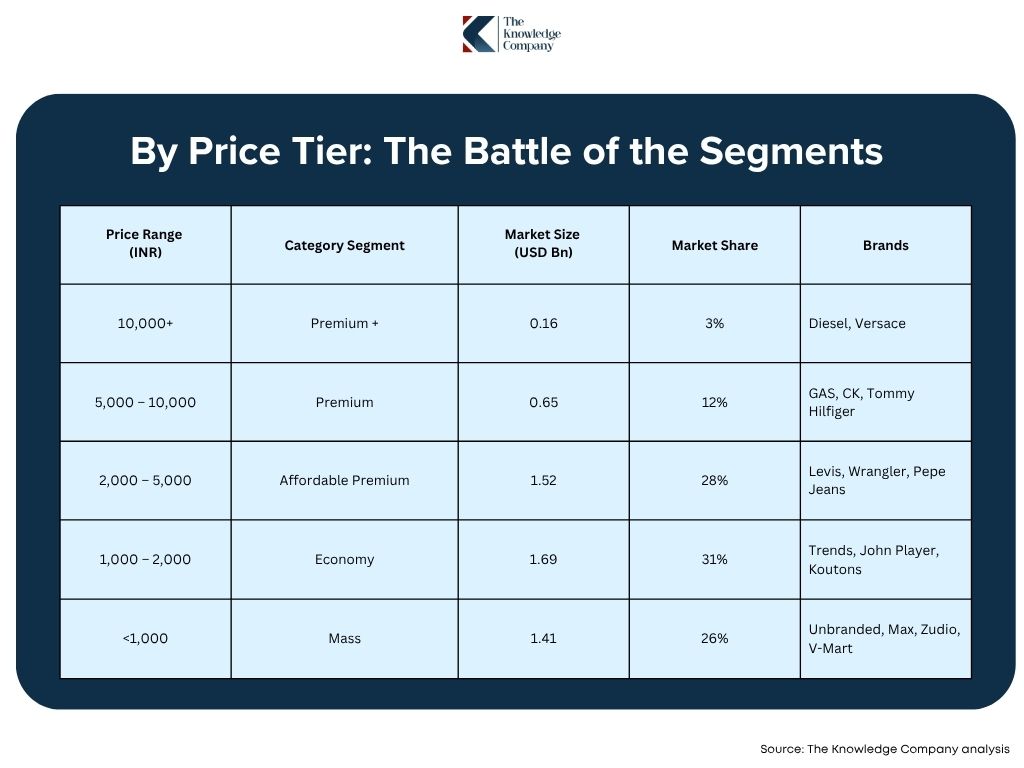

To fully comprehend the forces shaping the Indian denim market, a granular analysis of its key segments is essential. Deconstructing the market by price, consumer, and distribution channel reveals where competition is most intense and where the greatest opportunities for growth lie.

The Indian denim market is highly tiered, catering to a wide range of consumer needs.

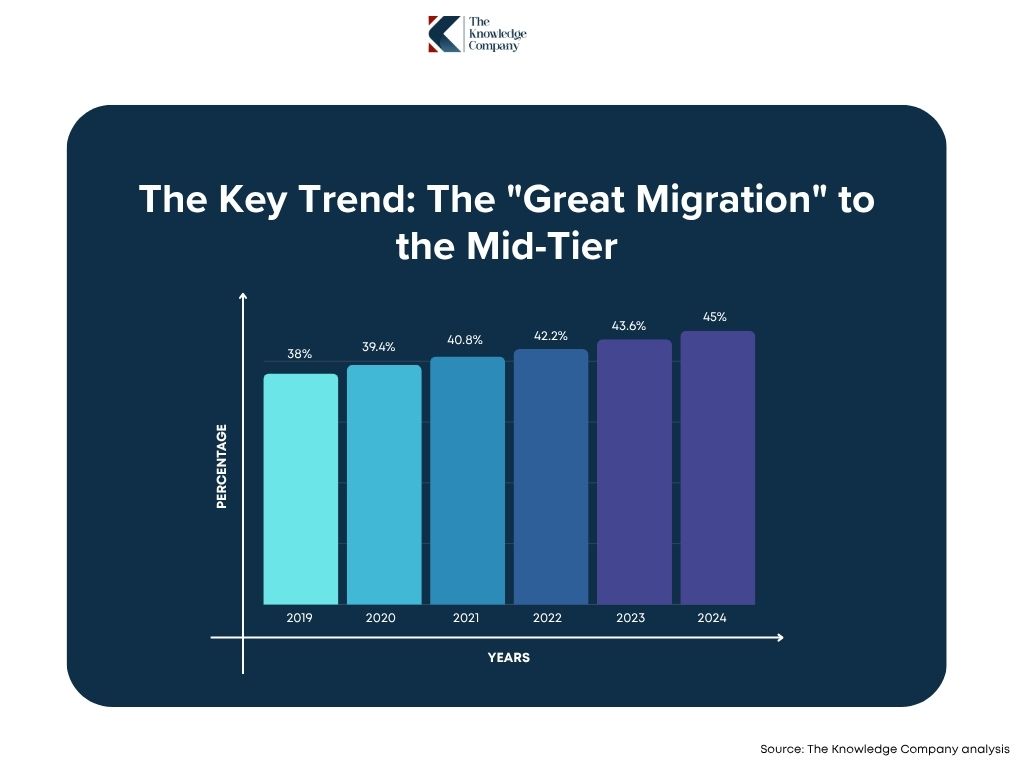

The Key Trend: The “Great Migration” to the Mid-Tier

The most important dynamic in this segment is a steady shift from unbranded to branded products.

While the premium and luxury segments are growing, their scale is limited. The most consequential opportunity for the industry lies in the volume and value growth generated by this migration into the mid-price tier.

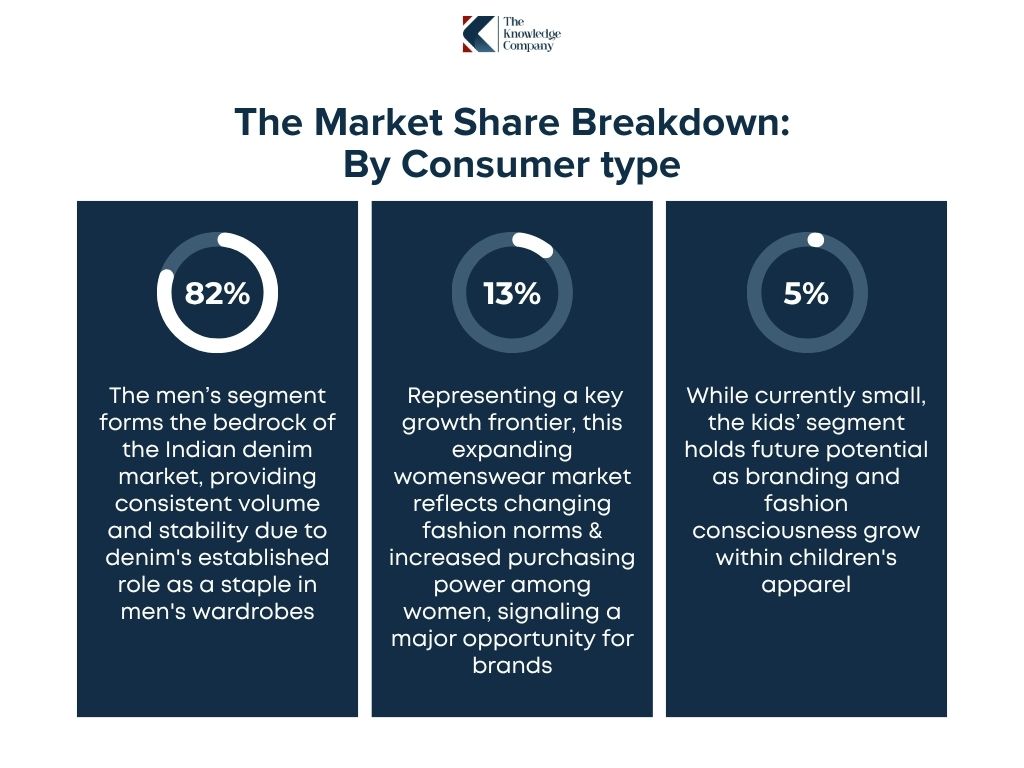

An analysis by consumer type reveals a clear strategic shift: the men’s segment remains the stable foundation, while the women’s segment is the primary engine of future growth.

The Market Share Breakdown:

Projections for 2030 suggest this gap will narrow, with the men’s share sliding to 78%, while women’s share rises to 15% and kids’ to 7%.

This growth is underpinned by rising female workforce participation, growing disposable incomes for women, and changing cultural norms that position denim as everyday wear. Younger women (Millennials and Gen Z) are demanding more diversity in fits, cuts, and designs for semi-formal and style-forward occasions.

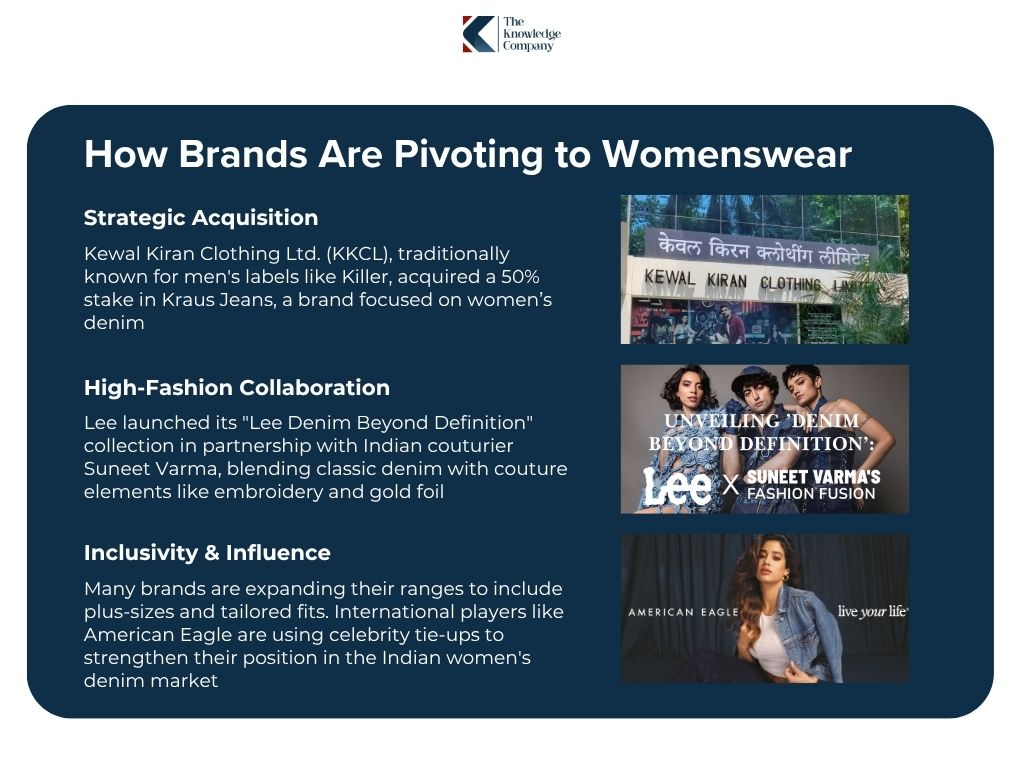

How Brands Are Pivoting to Womenswear

This shift is essential for growth, and brands are already making strategic moves.

The men’s segment remains essential, but long-term success will depend on capturing the women’s segment effectively.

The Indian denim market operates on two parallel—and increasingly intertwined—distribution systems.

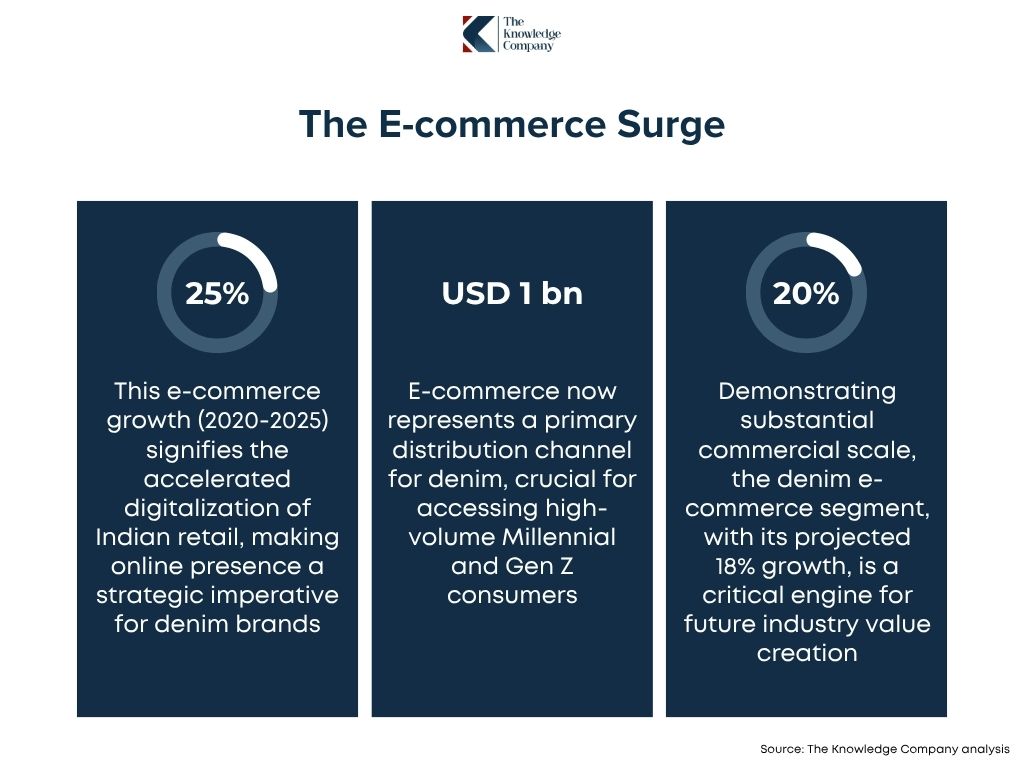

This online boom is fueled by rising internet and smartphone penetration in Tier-II and Tier-III cities, with Millennials and Gen Z as key adopters.

Critically, these channels are not isolated; they are converging. The rise of “hyper-value” e-commerce platforms is enabling small manufacturers—who once operated purely as B2B wholesalers—to sell directly to consumers. For instance, platforms like Meesho, which operate with a zero-commission policy, encourage unbranded vendors and MSMEs to become “micro-brands” online.

In this environment, the future winners will be those who can bridge the traditional and the new, strategically coordinating both channels to maximize reach and margin.

The Indian denim consumer in 2025 is a complex and rapidly evolving target. They are more digital, aspirational, and geographically diverse than ever before.

For any brand to establish a strong foothold, understanding their nuanced style preferences, purchase behaviors, and geographic distribution is critical.

The post-pandemic era has solidified a major shift in denim trends, moving decisively away from restrictive skinny jeans toward more relaxed and vintage-inspired styles.

The rise of Gen Z is one of the most transformative shifts in India’s retail sector. This cohort now represents a significant share of online shoppers and is fundamentally changing how brands are discovered, engaged with, and purchased.

A New Discovery Funnel For this generation, traditional marketing is almost irrelevant. Brand discovery no longer happens through broadcast media but organically and in real-time through digital channels. Social platforms, especially visual-first ones, are their primary gateway for exploring new products.

A New Discovery Funnel For this generation, traditional marketing is almost irrelevant. Brand discovery no longer happens through broadcast media but organically and in real-time through digital channels. Social platforms, especially visual-first ones, are their primary gateway for exploring new products.

The Rise of ‘Trend-First Commerce’ Gen Z’s purchase behavior is distinct:

These patterns make Gen Z the core engine behind India’s “trend-first commerce” model—characterized by frequent drops of affordable, trend-driven collections sold through online channels.

The Strategic Pivot: For denim brands, this means a decisive marketing budget shift away from traditional media is imperative. Success now requires a digital-first strategy focused on influencer collaborations and social commerce to stay relevant.

For denim brands, this means a decisive marketing budget shift away from traditional media is imperative. Success now requires a digital-first strategy focused on influencer collaborations and social commerce to stay relevant.

The next massive wave of growth for India’s denim market is emerging from Tier-2 and Tier-3 cities. These markets are the strongest drivers of new online shopper additions and are no longer low-value segments.

The opportunity for denim brands is clear: future success will depend on the ability to serve these new customers by mastering digital marketing, localized engagement, and last-mile logistics.

The Indian denim market is a highly competitive arena. It’s a complex battleground where established global brands, strong domestic players, and emerging digital-first labels all compete for consumer attention and market share.

This competition is intensified by the continued dominance of the unorganized sector, which keeps pricing pressure high.

Success in this multi-layered market requires flexible and well-calibrated strategies.

The market is defined by head-to-head competition between global and local players.

This dynamic highlights a core paradox in the industry: the gap between “mindshare” and “market share”.

While India’s total denim consumption is still dominated by the unorganized sector , consumer aspiration remains high for international labels.

This means brands must build equity while also mastering the realities of India’s fragmented retail landscape.

The Indian apparel and denim market is clearly moving towards strategic consolidation. This trend is visible in two key ways:

These moves signal a shift away from opportunistic buys.

Transactions are now more targeted, with investments aimed at capturing high-growth categories, building technological capabilities, and reinforcing supply chain resilience.

The investment environment for India’s consumer sector remains strong, providing favorable conditions for the denim market. In 2024 alone, apparel brands in India raised USD $119 Mn in funding.

A key example of this investor confidence is Freakins, a D2C denim brand.

Although direct PE-VC investments specifically into denim brands have been limited, the steady flow of capital into the supporting digital ecosystem is crucial.

This funding improves the reach, efficiency, and scalability for all apparel companies.

Backed by strong GDP growth, the 2025 outlook points to sustained investor confidence, with greater potential for direct investments into well-positioned denim and casual wear brands.

No analysis of the Indian denim market is complete without understanding its largest component: the unorganized sector.

This sprawling network of small-scale manufacturers isn’t a peripheral player; it’s the market’s dominant force.

It actively shapes pricing, supply, and consumer expectations on a massive scale.

The unorganized sector functions as an “invisible giant” , accounting for the majority percentage of all jeans sold in the domestic market by volume.

This isn’t a single entity but a network of hyper-localized, specialized manufacturing hubs across the country.

This decentralized structure is a key advantage. It enables the sector to respond quickly to regional demand shifts and offer products aligned with local preferences—a feat larger, centralized brands find difficult to replicate.

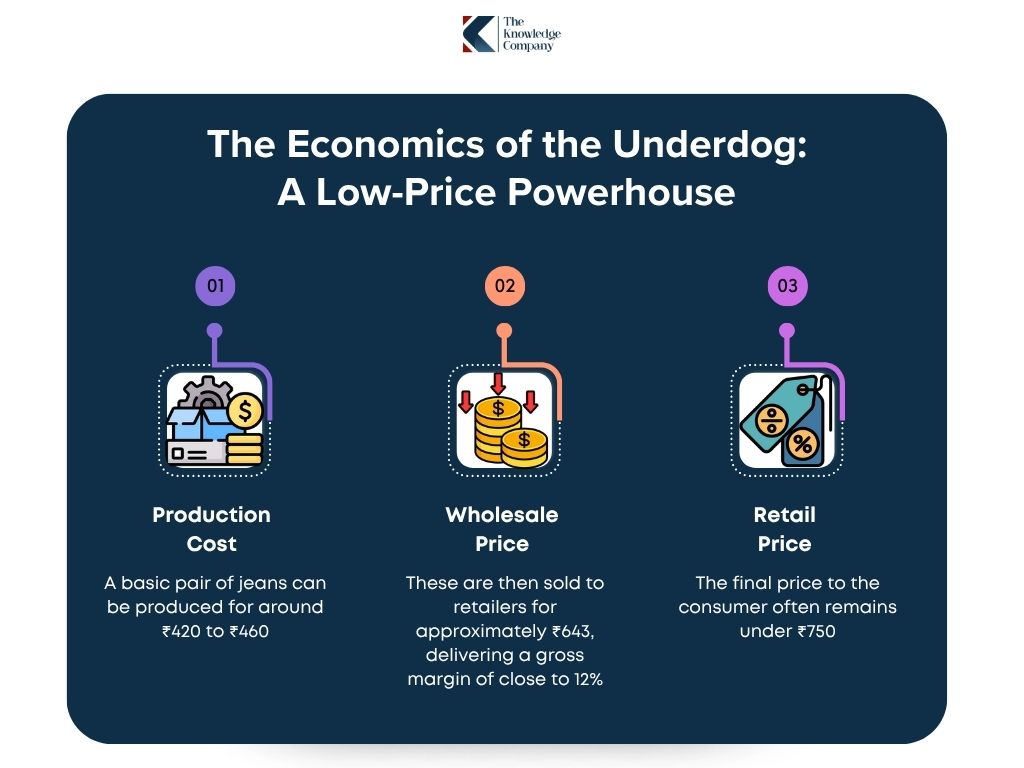

The strength of the unorganized sector lies in its lean, hyper-competitive cost structure. An estimate from the Delhi hub highlights these powerful economics:

This creates a formidable low-price barrier that organized brands struggle to cross. This cost advantage acts as a “price anchor” for the entire market, especially the Mass and Mid consumer segments.

When organized players set their prices, they aren’t just competing with other brands in malls; they are competing against the value proposition created by this vast, informal network.

For years, the narrative assumed a steady shift from the unorganized to the organized sector. Today, a deeper, technology-powered transformation is unfolding.

E-commerce platforms are acting as a “formalization engine”. They offer direct-to-consumer (D2C) access to thousands of small manufacturers in hubs like Ahmedabad and Delhi, allowing them to become micro-brands.

This enables them to bypass traditional wholesale layers and reach a national consumer base.

The unorganized sector is not simply shrinking; it is evolving. It is migrating into the digital economy, creating a new category of competitor that blends the low-cost advantages of the unorganized world with the reach, marketing tools, and scale of online commerce.

Sustainability is no longer a niche concern in the Indian denim industry; it has become a central strategic imperative.

This massive shift is being propelled by a dual-engine: evolving consumer consciousness and mounting regulatory pressure.

Together, they are compelling players across the entire value chain to rethink their materials, processes, and end-of-life solutions.

There is a clear and accelerating trend toward sustainability in denim, affecting both materials and manufacturing.

Case Study: Raymond UCO Denim One prominent example is Raymond UCO Denim, which has earned STeP by OEKO-TEX® certification. The company has actively implemented practices to reduce its environmental footprint, including:

Collaborating for Circularity To scale these efforts, the India Denim Deal Hub was recently launched. This collaborative platform brings together brands, mills, recyclers, and policymakers to accelerate circularity across the supply chain. Its primary focus is on scaling post-consumer recycled cotton and enabling closed-loop systems.

At present, sustainability functions as a key differentiator and a necessary operational standard. It is a premium attribute that can justify higher price points among conscious urban consumers and serves as a powerful marketing tool.

A major regulatory force reshaping the industry is the Zero Liquid Discharge (ZLD) mandate. This rule requires textile units to fully treat and reuse all their wastewater, allowing no liquid discharge into the environment.

In response, many denim manufacturers are investing heavily in water recovery systems, recycling infrastructure, and advanced treatment technologies.

Case Study: Arvind Ltd. Arvind Ltd.’s Santej unit provides a powerful example, hosting one of Asia’s largest ZLD plants. The unit’s wastewater treatment plant recycles up to 98% of its effluent using electrochemical oxidation techniques, demonstrating a deep ZLD capability.

The High Cost of Compliance The primary obstacle to widespread adoption is the high cost.

This high financial barrier places a heavy burden on smaller, unorganized producers, making compliance extremely difficult. As a result, the ZLD mandate is becoming a powerful driver of industry consolidation. It favors large, well-capitalized players that can absorb these costs and turn environmental compliance into a significant competitive advantage.

The future of the Indian denim market will be shaped by the interplay of supportive government policies , deepening global integration , and the strategic choices made by industry participants. Navigating this complex environment requires a clear understanding of the opportunities and a decisive commitment to action.

Government policies are providing strong support for the growth of India’s denim industry. Several key initiatives are creating a favorable environment for investment and manufacturing.

For manufacturers, the most effective approach is to use domestic incentives like the PLI scheme to move into higher-value denim production and then capitalize on new duty-free trade agreements to expand their reach in global markets.

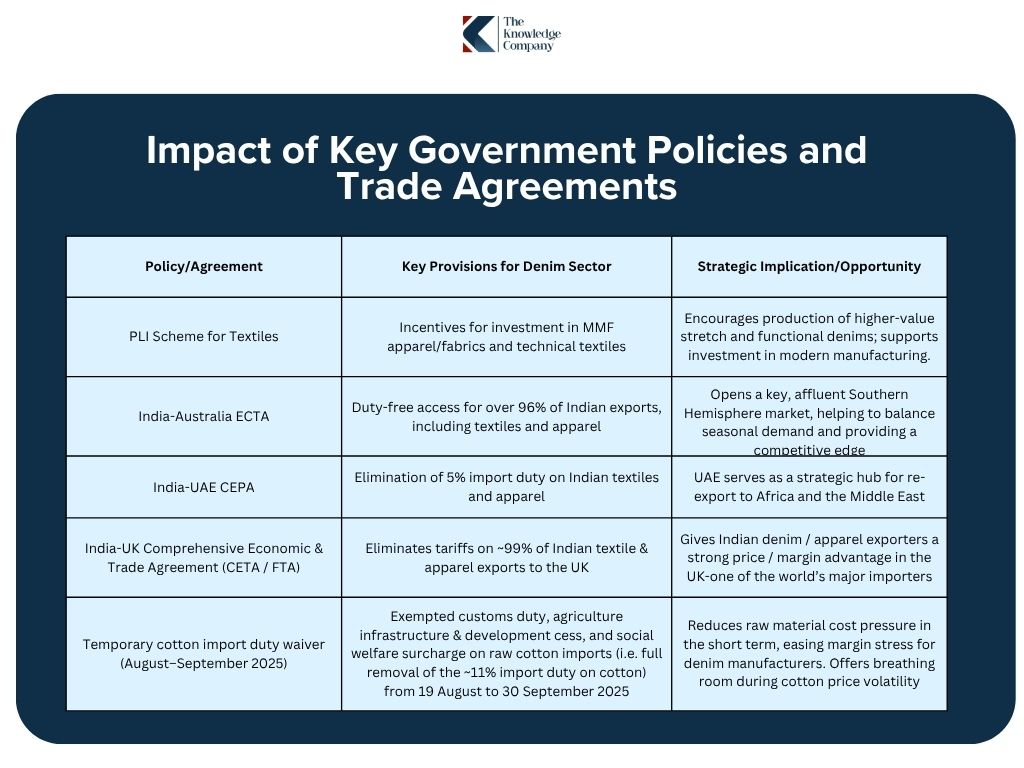

Table 2: Impact of Key Government Policies and Trade Agreements

The most effective approach for manufacturers is to use domestic incentives such as the PLI scheme to move into higher-value denim production and then capitalize on new duty-free trade agreements to expand their reach in global markets.

Based on this analysis, the following strategic recommendations are proposed for key stakeholders in the Indian denim ecosystem.

For Brands & Retailers

Growth will depend on a unified approach across e-commerce, direct-to-consumer, and offline retail. Companies must leverage digital platforms not only to reach consumers directly but also to strengthen traditional retail partnerships.

Growth will depend on a unified approach across e-commerce, direct-to-consumer, and offline retail. Companies must leverage digital platforms not only to reach consumers directly but also to strengthen traditional retail partnerships.

Growing consumer and regulatory focus on sustainability requires a shift toward eco-friendly methods. This includes using organic cotton , adopting water-efficient dyeing techniques , and increasing the use of recycled fibers in production.

Growing consumer and regulatory focus on sustainability requires a shift toward eco-friendly methods. This includes using organic cotton , adopting water-efficient dyeing techniques , and increasing the use of recycled fibers in production.

The Indian denim market in 2025 is at a clear turning point. It is rapidly evolving from a fragmented, production-led industry into a more organized, brand-driven, and digitally enabled ecosystem.

While significant challenges—such as supply chain inefficiencies and raw material price swings—certainly remain, the growth potential is undeniable.

This potential is powerfully driven by two key forces: a large, untapped domestic demand and supportive government policies.

The defining theme of this new era is convergence. This is seen in:

Ultimately, the companies that succeed in this new landscape will be those that build their strategy around three core pillars. They must:

This article is an adapted version of a feature originally written by The Knowledge Company/WGSN exclusively for IMAGES Business of Fashion. For more such content, log on to www.imagesbof.in