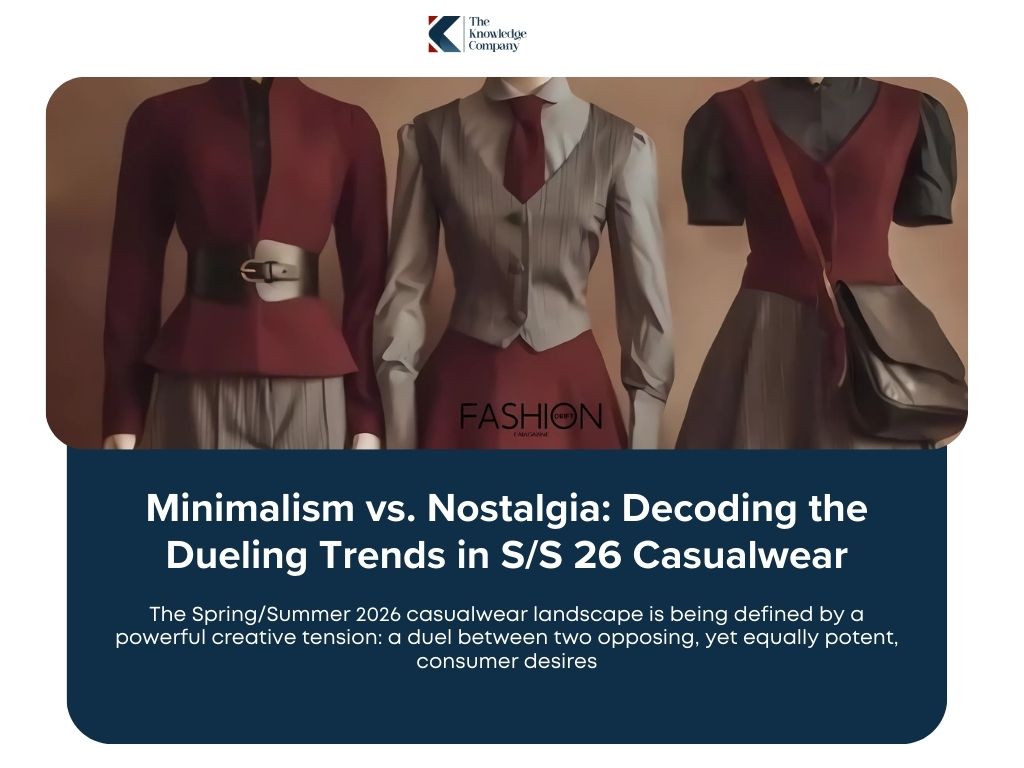

The Spring/Summer 2026 casualwear landscape is being defined by a powerful creative tension: a duel between two opposing, yet equally potent, consumer desires.

On one side is the drive towards refined minimalism—a demand for timeless, durable, and technologically advanced essentials. On the other is a powerful pull towards expressive nostalgia—a desire for emotionally resonant, playful, and sentiment-driven apparel.

For brands, navigating this “Playful Paradox” is the central strategic challenge of the season. Success is no longer about choosing one path, but about understanding how to cater to a consumer who simultaneously seeks longevity in their core wardrobe and expressive newness in their statement pieces.

Underpinning both of these aesthetic movements are the non-negotiable imperatives of our time: the integration of climate-adaptive technology and a commitment to sustainable innovation, which are now foundational expectations in every product category.

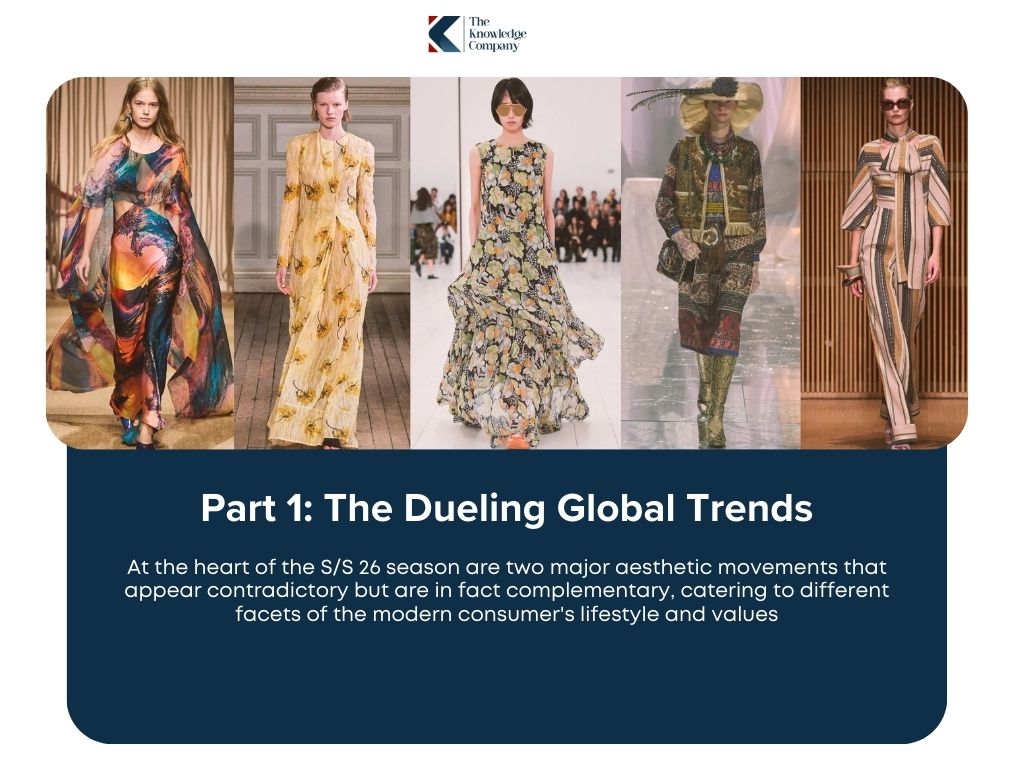

At the heart of the S/S 26 season are two major aesthetic movements that appear contradictory but are in fact complementary, catering to different facets of the modern consumer’s lifestyle and values.

Underpinning these aesthetic shifts are two foundational forces—climate and technology—that are becoming non-negotiable elements of modern apparel design and business strategy.

While aesthetics evolve, functionality remains the bedrock of athleisure. With escalating global temperatures, apparel that provides personal climate control is transitioning from a niche feature to a core consumer expectation.

Cooling technologies are becoming a key area of R&D and market penetration.

Brands like Sony and Torras are integrating thermoelectric cooling devices directly into garments, offering on-demand temperature regulation.

Simultaneously, advancements in smart cooling fabrics, which utilize mineral-activated fibres and phase-change materials (PCM), are revolutionizing how textiles manage body heat and moisture.

In Japan, brands like Kuchofuku and FreshService are pioneering air circulation technologies within outerwear to actively mitigate heat stress in urban settings.

The commercial urgency of this trend is backed by stark data. It is projected that 56% of the world’s population will live in cities by 2050, intensifying the urban heat island effect. The human impact is already significant: 92.9% of Africa’s workforce and 83.6% of workers in the Arab States are exposed to extreme heat.

With Asia warming at twice the global average, the demand for cooling apparel is set to explode. Brands that fail to prioritize heat-resistant, moisture-wicking, and UV-protective materials will be at a significant competitive disadvantage.

Beyond physical materials, technology is fundamentally reshaping the business of casualwear. The integration of digital tools is becoming essential for meeting consumer demands for hyper-personalization and transparency.

In India, a nation defined by its profound regional diversity, the global shifts in casualwear and athleisure are being interpreted through a unique cultural lens.

As digital connectivity brings about greater cultural exchange, brand success hinges on developing nuanced, inclusive, and culturally specific campaigns that resonate with a deeply rooted yet forward-looking consumer base.

This requires a strategy that moves beyond monolithic marketing to one that designs for specific personas over regions, with authenticity at the heart of brand engagement.

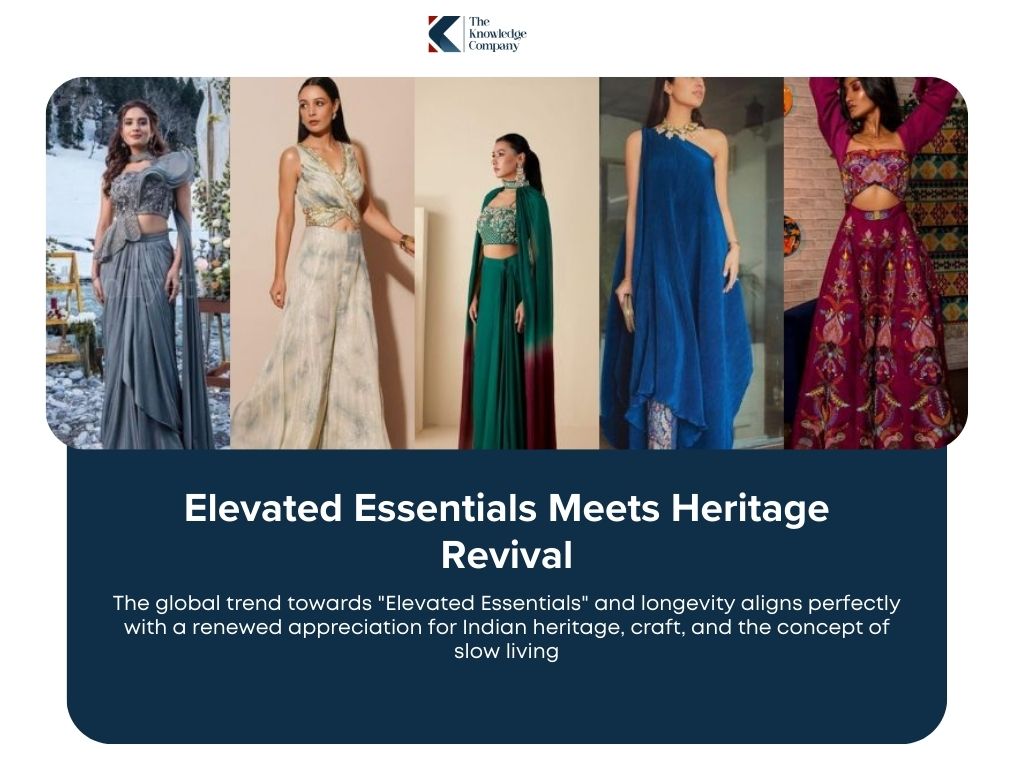

The global trend towards “Elevated Essentials” and longevity aligns perfectly with a renewed appreciation for Indian heritage, craft, and the concept of slow living.

Brands are finding success by connecting with consumers on a deeper cultural level, championing local stories and artisans. This strategy of “heritage over hype” allows brands to emerge as regional tastemakers.

Anita Dongre: The luxury Indian brand took over the historic City Palace in Jaipur for its “Rewild 23: Fashion For Good” fundraiser, demonstrating how high fashion can be integrated with cultural preservation and social responsibility by partnering with local foundations and NGOs.

Pahadi Local: This clean beauty brand is rooted in the Himalayas, with brand imagery that evokes serene mountain escapes and slow living. Its products use natural ingredients indigenous to the region, such as apricot kernel oil, directly appealing to the consumer desire for natural and wholesome products.

Subko Coffee: The coffee brand has made a name for itself by restoring heritage buildings in Mumbai and Bangalore for its cafes. It actively champions the layered cultures and stories behind these architectural gems through brand storytelling and unique innovations inspired by local lore.

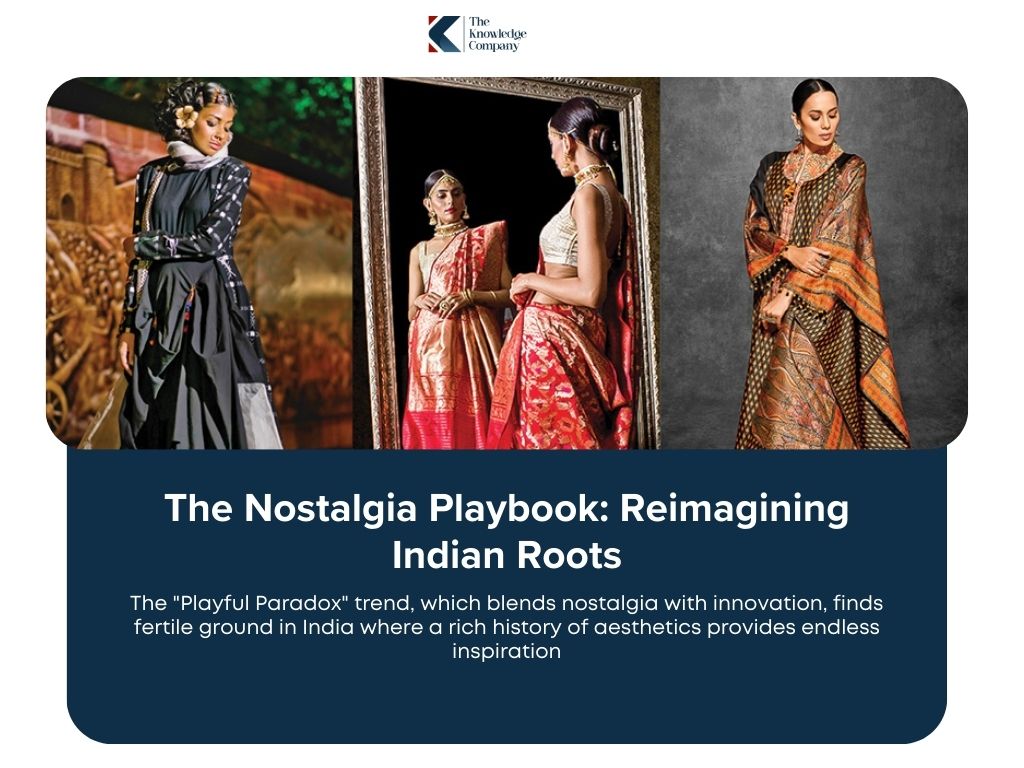

The “Playful Paradox” trend, which blends nostalgia with innovation, finds fertile ground in India where a rich history of aesthetics provides endless inspiration.

Young, digitally savvy consumers are eager to reconnect with their roots through a contemporary lens.

Sweet Karam Coffee: This D2C South Indian snacking brand effectively uses nostalgia and storytelling through its brand persona, “Janaki Paati,” emphasizing quality, taste, and tradition to connect with consumers on an emotional level.

Ziddi: A modern Indian fashion jewellery brand, Ziddi incorporates elements of play power, nostalgia, and youthful self-expression directly tied to traditional jewellery from various regions in its campaigns, successfully appealing to a younger demographic.

With its immense diversity, the Indian market is increasingly demanding more inclusive representation from brands.

Data shows that 48% of Indians called for inclusive representation from brands in 2023, a figure higher than the global average. This requires brands to spotlight under-represented communities and design for specific cultural needs.

Joy Personal Care: The Indian beauty brand featured popular gender-fluid entertainer Sushant Divgikar in a campaign calling for “unity in humanity”. The brand also reinforces its commitment to empowering women as an associate sponsor of the Gujarat Giants team in the Women’s Premier League (WPL).

Bold Helmets: This brand provides a powerful example of designing for a specific persona over a region. It creates specially designed helmets for young Sikh boys whose faith requires them to wear patkas or top-knotted turbans, making it difficult for them to use regular helmets.

This article is an adapted version of a feature originally written by The Knowledge Company/WGSN exclusively for IMAGES Business of Fashion. For more such content, log on to www.imagesbof.in

The S/S 26 season is defined by two dueling trends. The first is “Elevated Essentials,” a form of refined minimalism focused on durable, timeless, and modular garments made with sustainable and technologically advanced materials. The second is “Playful Paradox,” a trend that embraces expressive nostalgia, with retro ’70s-inspired fan-wear, detailed feminine designs, and emotionally resonant aesthetics.

Sustainability is a foundational expectation. It is driving innovation in materials, with brands adopting biodegradable fibres, upcycled textiles like those from Blue Sky Lab, and sustainable knits like Bananatex. It also influences the trend towards “investment dressing,” where consumers prefer durable, long-lasting pieces over disposable fast fashion.

In India, global trends are fused with the country’s rich cultural heritage. The “Elevated Essentials” trend aligns with a renewed appreciation for local craftsmanship and slow living, as seen in brands like Anita Dongre and Pahadi Local. The “Nostalgia” trend is interpreted through an Indian lens, with brands like Ziddi and Sweet Karam Coffee using traditional motifs and storytelling to connect with a younger, modern audience.